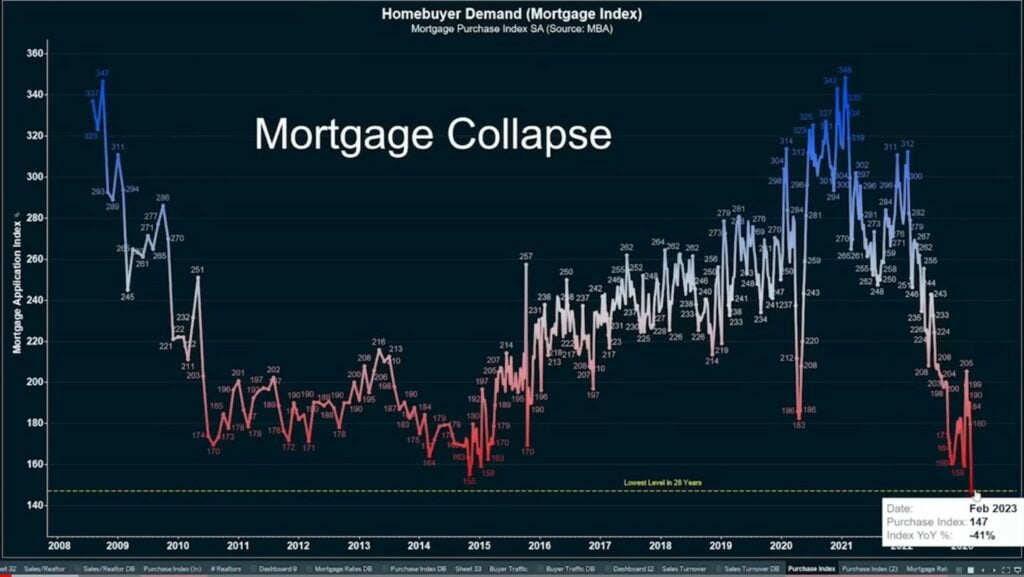

What to expect? Well, short of some financial event or credit crisis, probably more of the same. The big challenge with resort markets, aka discretionary markets, is the lag time. It generally takes about 18 months for economic factors in the real world to make their way to us.

Because we don’t have a large section of properties that “have to sell” to keep our market moving, as soon as buyers slow down, inventory piles up. At least that’s how it normally is. Truthfully, we are not that far from inventory pushing that market shift from “normal” to “soft.”

That being said, right now here are the main highlights of our current market for Single Family Homes.

Corolla, Duck, Southern Shores |

KDH, Kitty Hawk, Nags Head |

| Active – 110 | Active – 110 |

| Under Contract – 52 | Under Contract – 44 |

| Sold – 274 (30 buyers/month) | Sold – 289 (32 buyers/month) |

| Absorption Rate – 3.6 months | Absorption Rate – 3.4 months |

I double-checkedhose numbers, and it is such a coincidence to have the same active for both north and south markets! They are shockingly similar in all categories.

With 30 buyers a month, 180 active would make it a 6-month absorption rate. That’s only 70 more listings to push us into a soft/declining market. I don’t think it’s unrealistic to suggest we could be there by spring.

Real estate is long term investment. You can time it right, or you can hold and enjoy. If you have questions on what is the best strategy for you, call for an appointment.

It’s no secret the real estate market is in very bad shape right now. And in an effort to be as up-front as possible about the pros and cons, I wanted to create this quick list of the main things to consider before buying or selling.

It’s no secret the real estate market is in very bad shape right now. And in an effort to be as up-front as possible about the pros and cons, I wanted to create this quick list of the main things to consider before buying or selling.

Mid-year is upon us and not much has changed since the last report. I did notice an interesting trend regarding CASH in our marketplace. Here’s the deal. There have been 136 home sales in Duck and Corolla since January.

Mid-year is upon us and not much has changed since the last report. I did notice an interesting trend regarding CASH in our marketplace. Here’s the deal. There have been 136 home sales in Duck and Corolla since January.

What a mild winter we have had here at the beach so far. We are not complaining, that’s for sure.

What a mild winter we have had here at the beach so far. We are not complaining, that’s for sure.