We want to list our home,

but what if we get a lowball offer?

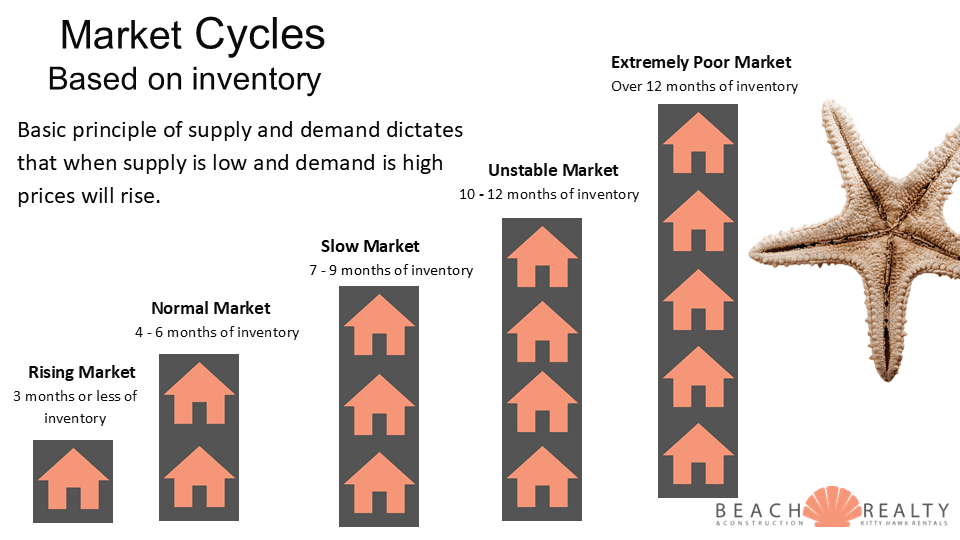

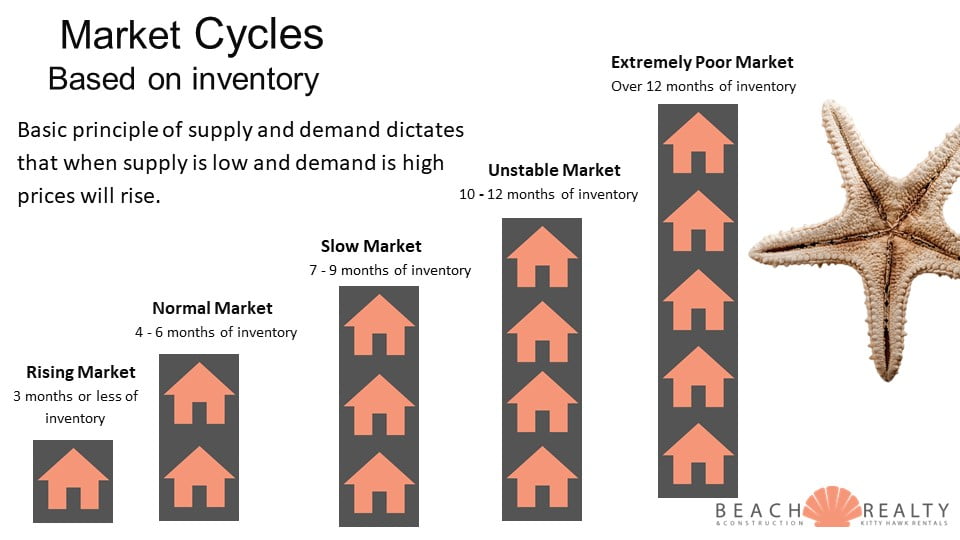

This is a common question I get, especially in a market like today. For the first time in many years, last week we clocked in MORE price reductions than new listings in a month. That’s a pretty significant milestone. The peak for pricing has officially passed. So what happens when a market peaks? As you know, what goes up must come down. This never takes place over night, so don’t sweat just yet.

The good news about this market cycle is we have a pretty decent blueprint of what happened during the last cycle to give insight and information.

Here are the basics:

2005 – Prices hit the peak

2008 – 2011 – These years we saw active declining in pricing (not overnight)

2012 – 2019 – These years very little changed, it was stagnant

2020 – Cycle started all over again.

Right now, I would say we are about the same as 2009. We knew there was some instability in 2023, it really started to show up in 2024 and we are very aware in 2025.

In this cycle, we may not bottom out as quickly as last cycle because the inventory levels aren’t rising like they normally would in a down cycle. So it is my prediction that the decline may take more than 3 years to occur.

All of that aside, if your plan is to “wait it out”, you need to really consider the cycle history and how long that could actually take. Spoiler alert: It’s always longer than you think. Having been through this before, I can tell you, next year is not going to be better.

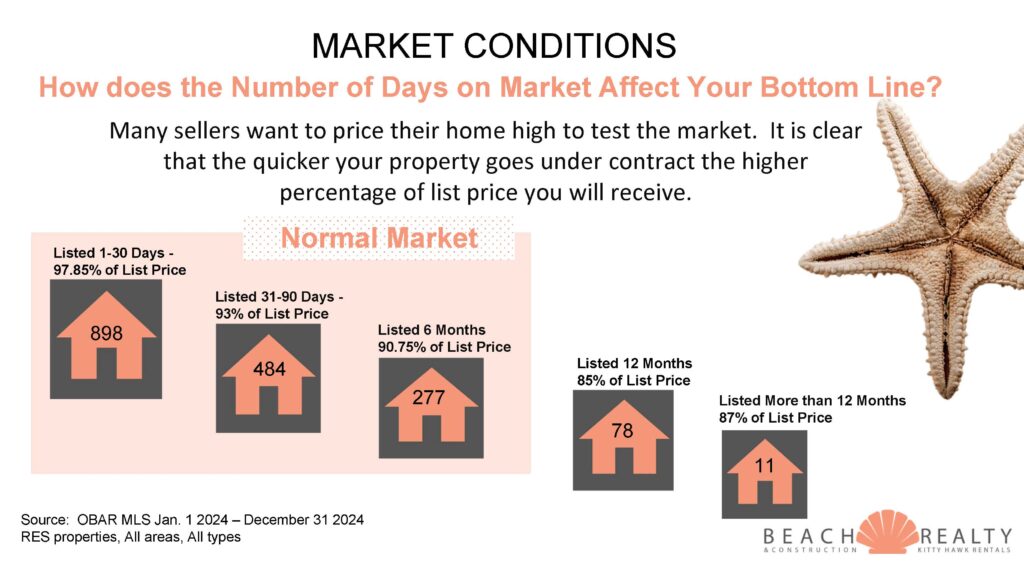

So, now what? How do we get the most for the home in the current cycle? Let’s look at what the stats tell us…

The majority of homes priced well and in demand are still selling within 30 to 60 days. Pricing “higher to negotiate” will likely cost you time and money. This is not the type of market for that strategy. If you get an offer, even a low offer here’s what you want to do.

- Revisit the recent comps. Did other similar homes sell, or reduce to a level that the offer now makes a little more sense? This does happen, especially if you’ve been on the market for a while. If your agent is not keeping you up to date on this information, ask them to.

- Consider making a counteroffer anyway. It’s a tricky market with not a whole lot of certainty as to what is ahead. Do not take it personally! If you were on the buying side, you would probably be doing the same thing. Instead, look at it big picture and keep the conversation going as long as possible.

- Get creative! Sometimes, price isn’t the only issue. Is there another component of the sale you could use to gain some ground and make the offer more enticing to the buyer without cutting the price? Price is a big factor, but sometimes not even the most important one.

Now is the time to be aware that lower offers are going to be the norm. We are back to over 70% of all properties selling under asking price. That’s just where we are. It’s business, after all.

Hiring the right agent will make a big difference in your bottom line.

Let me know if I can put together a winning strategy for you!

Now that we have 4 full months of data for 2025, let’s see how it compares to the same time last year. There are some noticeable changes to keep track of which is outlining the little by little deterioration of our current market.

Now that we have 4 full months of data for 2025, let’s see how it compares to the same time last year. There are some noticeable changes to keep track of which is outlining the little by little deterioration of our current market.

You may have heard in the news about the NAR Settlement, and there was a lot of bad information floating around. Having been licensed in NC since 1997, teaching the real estate license law for 15 years, and a member of the Board of Directors for the Outer Banks Association of Realtors, I’m bringing a snapshot of what to expect as we approach the implementation date on August 17th.

You may have heard in the news about the NAR Settlement, and there was a lot of bad information floating around. Having been licensed in NC since 1997, teaching the real estate license law for 15 years, and a member of the Board of Directors for the Outer Banks Association of Realtors, I’m bringing a snapshot of what to expect as we approach the implementation date on August 17th.