Now that we have 4 full months of data for 2025, let’s see how it compares to the same time last year. There are some noticeable changes to keep track of which is outlining the little by little deterioration of our current market.

Now that we have 4 full months of data for 2025, let’s see how it compares to the same time last year. There are some noticeable changes to keep track of which is outlining the little by little deterioration of our current market.

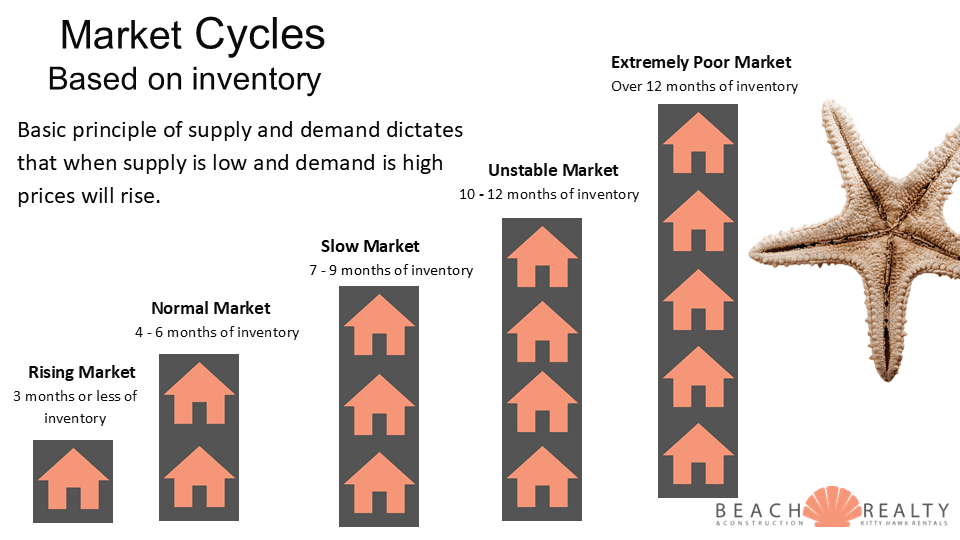

Keep in mind, markets don’t drop overnight. If you pay attention, you can most certainly see it coming. The main reason these shifts take 5 to 6 years is due to the state of denial many sellers find themselves in at the beginning of the shift. Markets are fluid. You have to adjust as new information comes in if you want to net the most when selling in an actively changing market, such as what we have right now.

Here’s how each area breaks down:

|

Jan to Apr 2024 |

Jan to Apr |

||

| New Listings |

1,294 |

1,351 |

*Inventory UP 5% |

| Price Reductions |

770 |

933 |

*Price changes UP 29% |

| Sold Listings |

685 |

658 |

*Buyer demand DOWN 5% |

This data tells us year-over-year inventory is creeping up, demand is slowing, but PRICING is changing at a rapid pace. Homes are still selling within 30 days if priced right.

Buyers are making offers knowing the price correction is coming, and they are trying to build it in on the front end. Be prepared to start your listing strategy with a value forward stance on price. Do not try to build in a negotiation buffer, it will only cost you time on the market and an eventual price correction down the road.

Our statistics show us if you price it correctly and sell within 30 days, typically it will sell for 97.85% of asking price.

If you are thinking about buying or selling, contact me so we can create a winning strategy for your goals.

As we approach the second half of the year, it’s important to notice the little shifts happening along the way. Remember, real estate markets don’t crash overnight. It happens slowly at first, then all of a sudden. We are in the slowly at first phase.

As we approach the second half of the year, it’s important to notice the little shifts happening along the way. Remember, real estate markets don’t crash overnight. It happens slowly at first, then all of a sudden. We are in the slowly at first phase.

What a mild winter we have had here at the beach so far. We are not complaining, that’s for sure.

What a mild winter we have had here at the beach so far. We are not complaining, that’s for sure.