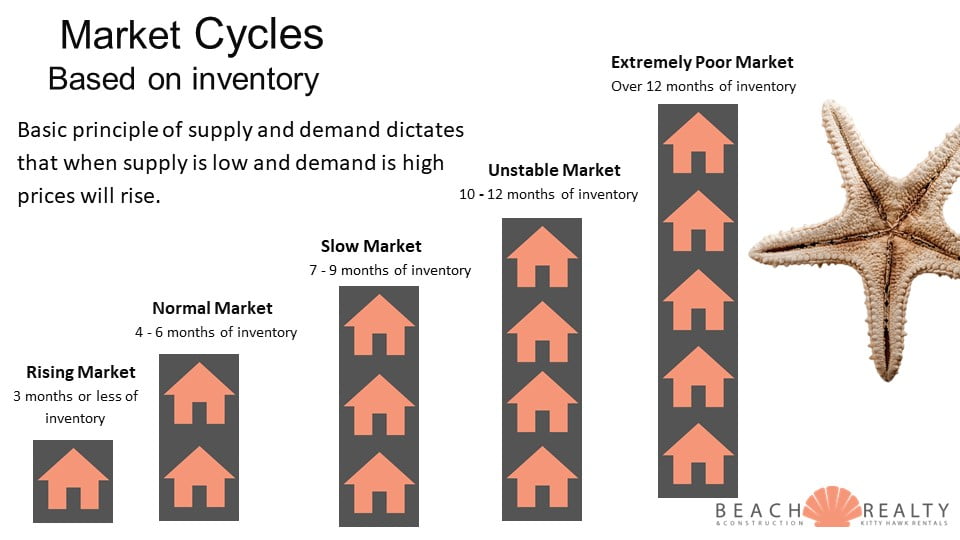

We are just watching the numbers closely. You can really see the shift coming in little by little.

| January 2024 | September 2024 | |

| Active Inventory – All | 870 | 1184 |

| Active Inventory Homes – | 424 | 586 |

| Under Contract – | 24% | 21% |

| Absorption Rate – | 5.4 | 6.4 |

| SF Absorption Rate – | 4.3 | 5.3 |

| Price Reductions/Month – | 171 | 307 |

If you would like a more specific analysis for your real estate goals, give me a call!

You may have heard in the news about the NAR Settlement, and there was a lot of bad information floating around. Having been licensed in NC since 1997, teaching the real estate license law for 15 years, and a member of the Board of Directors for the Outer Banks Association of Realtors, I’m bringing a snapshot of what to expect as we approach the implementation date on August 17th.

You may have heard in the news about the NAR Settlement, and there was a lot of bad information floating around. Having been licensed in NC since 1997, teaching the real estate license law for 15 years, and a member of the Board of Directors for the Outer Banks Association of Realtors, I’m bringing a snapshot of what to expect as we approach the implementation date on August 17th. In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see!

In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see! History repeats itself. A saying I’m sure you’ve heard and said dozens of times. I might not yet be a half of a century old, but I’m old enough, and have been in this business long enough (27 years) to recognize a similar pattern. Let’s revisit the timeline of the Outer Banks real estate market from the year 2000.

History repeats itself. A saying I’m sure you’ve heard and said dozens of times. I might not yet be a half of a century old, but I’m old enough, and have been in this business long enough (27 years) to recognize a similar pattern. Let’s revisit the timeline of the Outer Banks real estate market from the year 2000.