For Last 90 days of 2023

What to expect? Well, short of some financial event or credit crisis, probably more of the same. The big challenge with resort markets, aka discretionary markets, is the lag time. It generally takes about 18 months for economic factors in the real world to make their way to us.

Because we don’t have a large section of properties that “have to sell” to keep our market moving, as soon as buyers slow down, inventory piles up. At least that’s how it normally is. Truthfully, we are not that far from inventory pushing that market shift from “normal” to “soft.”

That being said, right now here are the main highlights of our current market for Single Family Homes.

Corolla, Duck, Southern Shores |

KDH, Kitty Hawk, Nags Head |

| Active – 110 | Active – 110 |

| Under Contract – 52 | Under Contract – 44 |

| Sold – 274 (30 buyers/month) | Sold – 289 (32 buyers/month) |

| Absorption Rate – 3.6 months | Absorption Rate – 3.4 months |

I double-checkedhose numbers, and it is such a coincidence to have the same active for both north and south markets! They are shockingly similar in all categories.

With 30 buyers a month, 180 active would make it a 6-month absorption rate. That’s only 70 more listings to push us into a soft/declining market. I don’t think it’s unrealistic to suggest we could be there by spring.

Real estate is long term investment. You can time it right, or you can hold and enjoy. If you have questions on what is the best strategy for you, call for an appointment.

March 2022 Market Update

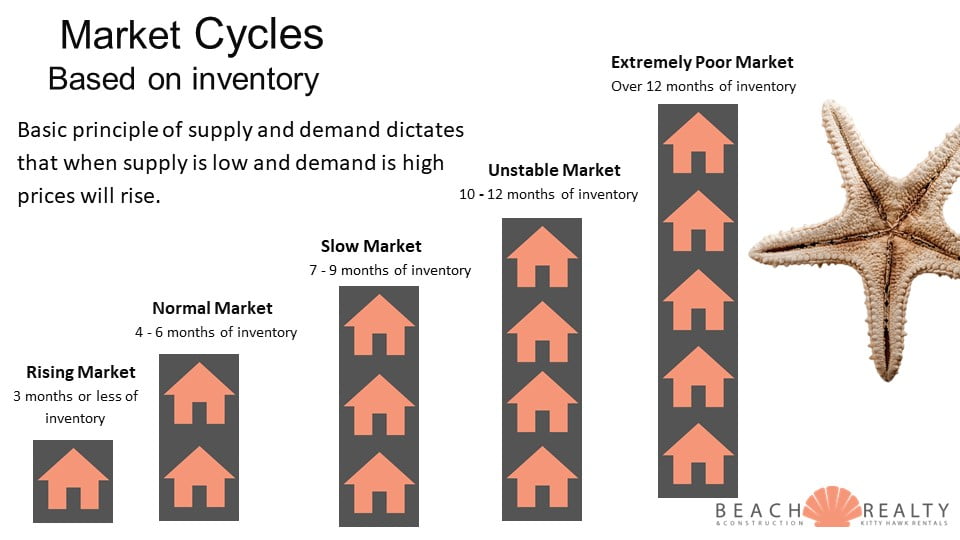

Let’s talk about INVENTORY. Most people don’t realize that inventory level is the key determining factor for real estate prices. If I had a dollar for every time someone asked about the bridge in relationship to values, I would have a whole lot of dollars! And yes, there are a lot of factors that play into value.

Let’s talk about INVENTORY. Most people don’t realize that inventory level is the key determining factor for real estate prices. If I had a dollar for every time someone asked about the bridge in relationship to values, I would have a whole lot of dollars! And yes, there are a lot of factors that play into value.

For example:

- Condition – buyers today don’t want to fix old problems

- Location – location has always been top of the list

- Rentability – Not every buyer in our market cares about this, but it does help

- Financing – Being able to get good terms

- Insurance – Getting the best premiums makes the home more saleable

However, inventory levels trump all other factors when determining value. Just 3 short years ago the inventory levels in Corolla were over 2 years. Now, it’s barely one month. The old faithful supply and demand is king when it comes to prices going up or down.

Let’s also realize these cycles historically (nearly 100 years worth of data) last for 20 years. The last cycle began in 2000. So regardless of COVID, we were due for an up market. I do believe that COVID accelerated what should have taken 3 years to get where we are into 2 years. That being said, the last up cycle lasted for 5 or 6 years. It’s not clear how long this one will last. Especially with everything going on, who knows.

What we do know is that watching the stats is the same as having a crystal ball. Nothing can change until inventory levels change. That doesn’t look to move any time soon. We are just beginning the spring market where our inventory usually increases by 30%.

Here’s the number of homes currently for sale and under contract for each area.

Area For Sale Under Contract

Corolla – 22 86

4 Wheel – 8 8

Duck – 13 23

Southern Sh 10 16

Kitty Hawk 9 8

KDH 12 53

Nags Head 12 26

These numbers still blow my mind! We all want to know what’s going to happen. Here’s what we can count on, what goes up, must come down. The big question is WHEN? My answer, watch the inventory and you’ll know. When we get back to 4 to 6 months, that’s when it will start.

Meanwhile, if you have any questions about buying or selling in this crazy market, give me a call!

In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see!

In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see! Mid-year is upon us and not much has changed since the last report. I did notice an interesting trend regarding CASH in our marketplace. Here’s the deal. There have been 136 home sales in Duck and Corolla since January.

Mid-year is upon us and not much has changed since the last report. I did notice an interesting trend regarding CASH in our marketplace. Here’s the deal. There have been 136 home sales in Duck and Corolla since January.

What an interesting few years in the real estate world, and the world in general! I got to spend a good bit of time with my niece and nephew over the last 18 months and do a little bit of traveling. After 26 years in the business, I was so grateful and fortunate to have the opportunity to still assist some new and past clients while enjoying that precious time with family!

What an interesting few years in the real estate world, and the world in general! I got to spend a good bit of time with my niece and nephew over the last 18 months and do a little bit of traveling. After 26 years in the business, I was so grateful and fortunate to have the opportunity to still assist some new and past clients while enjoying that precious time with family!