As we approach the second half of the year, it’s important to notice the little shifts happening along the way. Remember, real estate markets don’t crash overnight. It happens slowly at first, then all of a sudden. We are in the slowly at first phase.

As we approach the second half of the year, it’s important to notice the little shifts happening along the way. Remember, real estate markets don’t crash overnight. It happens slowly at first, then all of a sudden. We are in the slowly at first phase.

Our market here gets insulated because it’s not a primary market. Being a discretionary sale and discretionary purchase for the majority of transactions, it provides a lag time from when we start to see primary markets destabilize.

If you are thinking about what to do with your OBX investment home, you need to look big picture. Consider first and foremost, just because you don’t HAVE to sell, does not automatically mean that keeping the home is in the best financial interest for your family. Always consult your financial adviser for guidance.

Let’s now take a look at the two options, sell or keep. Regardless of what you choose, this information will help you set up the best expectations for either choice.

Sell

- Good news! Prices are still at record highs. You have not missed the boat.

- However, pricing strategy must remain fluid. No longer set the price and then 3 months later look at it. If you want to maximize profit here, you must be the trend setter, not the follower.

- Inventory is rising – up 29% from this time last year

- Demand is dropping – down almost 10% from last year, and last year demand dropped 50% from 2022

- Price reductions are increasing – in May 368 new listings came on and 287 listings had a price reduction

- Must be negotiable – 66% of properties sold are below asking price.

- Affordability is still the number one concern for buyers

If you employ a listing strategy with this in mind, you will maximize your return and get the home sold in a reasonable amount of time.

Keep

- Remember how these cycles have worked over the years.

- Boom 1985/86 – fell apart early 90’s – stagnant until 2000.

- Boom again 2004/05 – fell apart 2008/09 stagnant until 2019/20.

- Boom 2021/22 – 2023 activity dropped by half, pricing is just starting to crack with price reductions and under asking price sales.

- If the pattern continues it could be stagnant again until 2035 or longer.

- Rising Insurance as well as other increasing vendor costs.

- be prepared for at least a 14% increase in dwelling policies and unknown yet for homeowners.

- Service providers are increasing costs: lawn care, pool/hot tub maintenance, linens, etc

- Return to pre-pandemic rental income.

- It starts with lower vacancy rates. 2024 is already seeing only 90% booking.

- Next will be set lower rates – discounts are already happening.

- If you stay, the cost to own will go up, with income to support going down.

- Prepare for capital improvements.

- Tightening insurance underwriting regulations are requiring updates to stay insured. Roof, water heater, etc

- Continued lack of demand for homes that have not been updated. Especially as inventory increases, you’ll need to have prime condition and updating to be chosen.

- Reality of a major storm this year or next. Let’s face it, no one likes to say it, but we haven’t had a hurricane since 2018. Generally, we see a 6 to 9 year pattern.

If you do decide to keep the home through the next cycle, let’s at least put together a plan to get your home updated and where to best spend the money. I also have a list of trusted vendors who can help you get things done.

Now that you have the big picture, let me know if I can be of any help as we navigate this next market shift.

In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see!

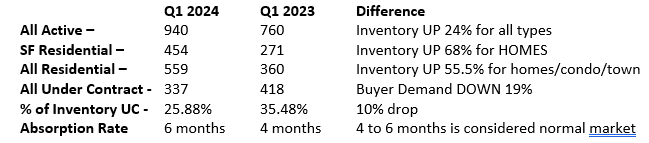

In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see! What a difference a year makes! Long story short, there are some BIG moves that are happening. I’ve talked before about algorithmic decay. This chart here is exactly that! Little, by little, by little, then bang. That’s how markets change. Tale as old as time, song as old as rhyme, it’s almost as good as a crystal ball.

What a difference a year makes! Long story short, there are some BIG moves that are happening. I’ve talked before about algorithmic decay. This chart here is exactly that! Little, by little, by little, then bang. That’s how markets change. Tale as old as time, song as old as rhyme, it’s almost as good as a crystal ball.

From what I have been told, there were many meetings amongst lots of organizations, Homebuilders Association and NC Realtors are included in the reshaping of the wastewater regulations. Negotiations were settled, the meeting concluded, and everyone went home. The night before the vote, the bill is sent out. Unbeknownst to all signings, changes were made in favor of the Septic Tank Association’s lobbyists, resulting in the incoming “shituation” we have now. This DID come from the private sector and the only way out of it is legislatively.

From what I have been told, there were many meetings amongst lots of organizations, Homebuilders Association and NC Realtors are included in the reshaping of the wastewater regulations. Negotiations were settled, the meeting concluded, and everyone went home. The night before the vote, the bill is sent out. Unbeknownst to all signings, changes were made in favor of the Septic Tank Association’s lobbyists, resulting in the incoming “shituation” we have now. This DID come from the private sector and the only way out of it is legislatively. With all the insurance and septic news, I’m going to be brief on this month’s market report and just give you the numbers straight up. With only one month in, there isn’t a lot to analyze anyway.

With all the insurance and septic news, I’m going to be brief on this month’s market report and just give you the numbers straight up. With only one month in, there isn’t a lot to analyze anyway. History repeats itself. A saying I’m sure you’ve heard and said dozens of times. I might not yet be a half of a century old, but I’m old enough, and have been in this business long enough (27 years) to recognize a similar pattern. Let’s revisit the timeline of the Outer Banks real estate market from the year 2000.

History repeats itself. A saying I’m sure you’ve heard and said dozens of times. I might not yet be a half of a century old, but I’m old enough, and have been in this business long enough (27 years) to recognize a similar pattern. Let’s revisit the timeline of the Outer Banks real estate market from the year 2000.