The impact of slowly rising inventory and decreased demand is starting to add up here on the Outer Banks. Don’t get me wrong, homes in good condition, location and priced right are still selling very quickly. We don’t have an overabundance of inventory, yet. However, we are definitely seeing some markets shifting faster than others.

Here’s how each area breaks down:

| Area | Active Listings | Sold/ Month |

Month Supply |

| Corolla | 161 | 10.6 | 15 |

| Duck | 33 | 3 | 11 |

| S. Shores | 32 | 5 | 6.4 |

| Kitty Hawk | 24 | 7 | 3.4 |

| Kill Devil Hills | 121 | 23 | 5.2 |

| Nags Head | 48 | 10 | 4.8 |

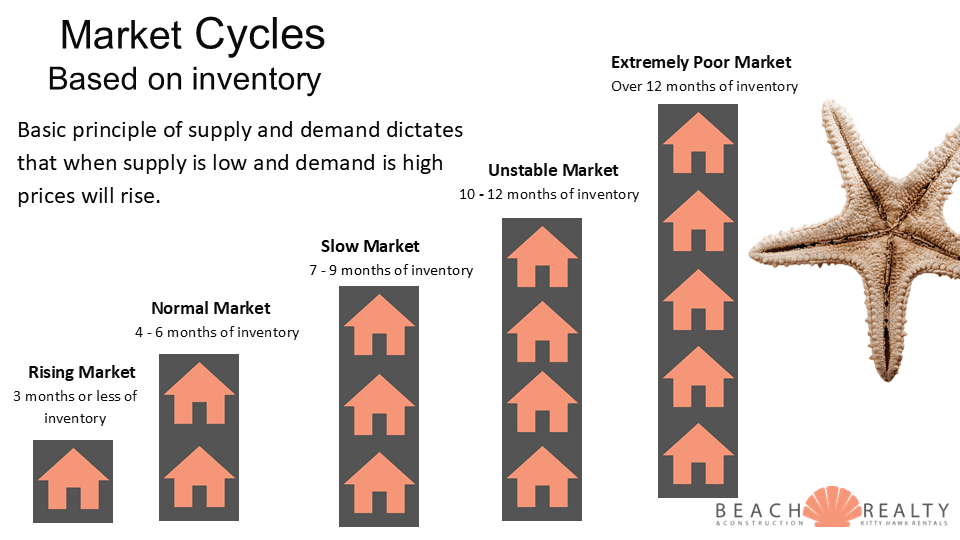

The relationship of inventory to number of homes sold per month gives us the absorption rate. The absorption rate tells us how many months it would take to sell out the inventory at the current rate of sales. That is a direct reflection of the “health” of a market, or describes what type of market we are in. The chart below lists this out. Based on this, you can see how each area is performing.

When shifting to a different market it’s common to see some areas performing differently than others. If you consider the higher end markets will generally slow down first, and that is reflected here.

If you are thinking of selling in one of those markets, the time is now.

In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see!

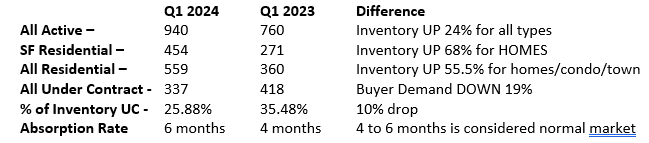

In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see! What a difference a year makes! Long story short, there are some BIG moves that are happening. I’ve talked before about algorithmic decay. This chart here is exactly that! Little, by little, by little, then bang. That’s how markets change. Tale as old as time, song as old as rhyme, it’s almost as good as a crystal ball.

What a difference a year makes! Long story short, there are some BIG moves that are happening. I’ve talked before about algorithmic decay. This chart here is exactly that! Little, by little, by little, then bang. That’s how markets change. Tale as old as time, song as old as rhyme, it’s almost as good as a crystal ball.

A lot of agents will do presentations on how they came up with a price for your home. It is a task that does require some skill. The challenge of course is getting the seller to agree to the pricing suggestions.

A lot of agents will do presentations on how they came up with a price for your home. It is a task that does require some skill. The challenge of course is getting the seller to agree to the pricing suggestions. It’s no secret the real estate market is in very bad shape right now. And in an effort to be as up-front as possible about the pros and cons, I wanted to create this quick list of the main things to consider before buying or selling.

It’s no secret the real estate market is in very bad shape right now. And in an effort to be as up-front as possible about the pros and cons, I wanted to create this quick list of the main things to consider before buying or selling.

It’s no secret the real estate market on the Outer Banks is shifting. Even as we move into a seller’s market, keep in mind a majority of our home sales are secondary homes. This means more than 50% of our home buyers will spend up to 2 years searching for the right home. They can do that because they aren’t physically moving into the home.

It’s no secret the real estate market on the Outer Banks is shifting. Even as we move into a seller’s market, keep in mind a majority of our home sales are secondary homes. This means more than 50% of our home buyers will spend up to 2 years searching for the right home. They can do that because they aren’t physically moving into the home.