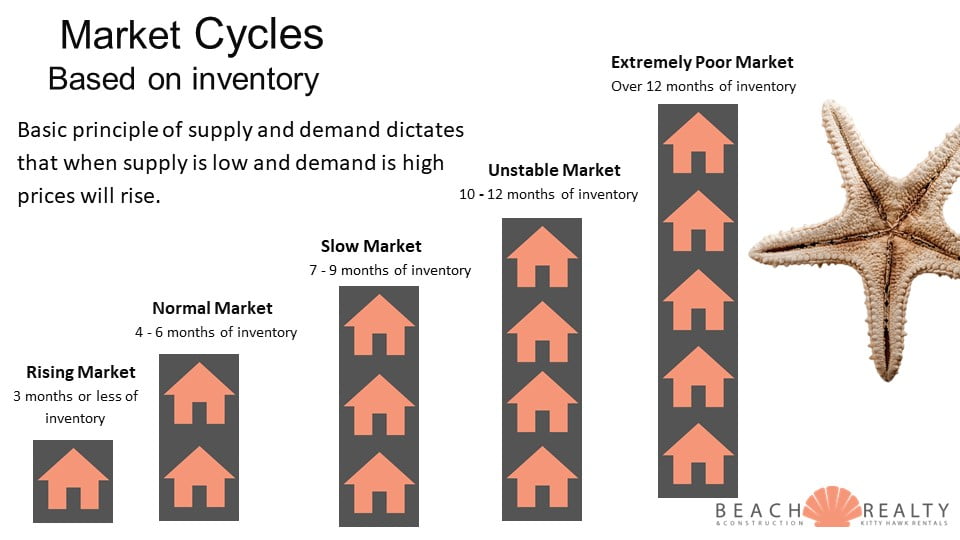

2024 market saw a few distinct changes. Higher inventory and massive price reductions. We are already starting to see a small change in pricing – roughly 5 – 7% depending on location. If inventory keeps rising, we could see the pricing change go up.

Here’s how December Year over Year looks:

|

December 2024 |

December 2025 |

|

| Active – 585 | Active – 434 | *Single Family |

| U/C – 244 | U/C – 235 | *All Classes |

| Absorption Rate – 6.59 | Absorption Rate – 4.89 |

As you can see inventory is up 35%.

Yet the number of properties under contract is about the same. While that number has not gone down, what happens when you have more homes for sale and the same or fewer buyers? Law of supply and demand is in play. That is why the absorption rate (months of inventory) has gone up so much.

The statistics are telling us the slow down will continue this year. With mortgage rates higher and mortgage applications at their lowest levels ever, we could see a double-digit drop in pricing this year. I’ll be watching!

In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see!

In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see! What a difference a year makes! Long story short, there are some BIG moves that are happening. I’ve talked before about algorithmic decay. This chart here is exactly that! Little, by little, by little, then bang. That’s how markets change. Tale as old as time, song as old as rhyme, it’s almost as good as a crystal ball.

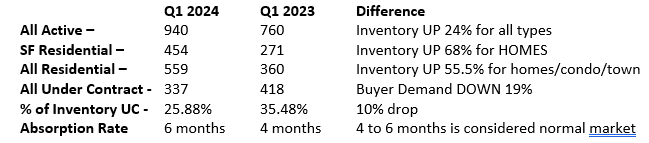

What a difference a year makes! Long story short, there are some BIG moves that are happening. I’ve talked before about algorithmic decay. This chart here is exactly that! Little, by little, by little, then bang. That’s how markets change. Tale as old as time, song as old as rhyme, it’s almost as good as a crystal ball.

From what I have been told, there were many meetings amongst lots of organizations, Homebuilders Association and NC Realtors are included in the reshaping of the wastewater regulations. Negotiations were settled, the meeting concluded, and everyone went home. The night before the vote, the bill is sent out. Unbeknownst to all signings, changes were made in favor of the Septic Tank Association’s lobbyists, resulting in the incoming “shituation” we have now. This DID come from the private sector and the only way out of it is legislatively.

From what I have been told, there were many meetings amongst lots of organizations, Homebuilders Association and NC Realtors are included in the reshaping of the wastewater regulations. Negotiations were settled, the meeting concluded, and everyone went home. The night before the vote, the bill is sent out. Unbeknownst to all signings, changes were made in favor of the Septic Tank Association’s lobbyists, resulting in the incoming “shituation” we have now. This DID come from the private sector and the only way out of it is legislatively. With all the insurance and septic news, I’m going to be brief on this month’s market report and just give you the numbers straight up. With only one month in, there isn’t a lot to analyze anyway.

With all the insurance and septic news, I’m going to be brief on this month’s market report and just give you the numbers straight up. With only one month in, there isn’t a lot to analyze anyway. History repeats itself. A saying I’m sure you’ve heard and said dozens of times. I might not yet be a half of a century old, but I’m old enough, and have been in this business long enough (27 years) to recognize a similar pattern. Let’s revisit the timeline of the Outer Banks real estate market from the year 2000.

History repeats itself. A saying I’m sure you’ve heard and said dozens of times. I might not yet be a half of a century old, but I’m old enough, and have been in this business long enough (27 years) to recognize a similar pattern. Let’s revisit the timeline of the Outer Banks real estate market from the year 2000. It’s no secret the real estate market is in very bad shape right now. And in an effort to be as up-front as possible about the pros and cons, I wanted to create this quick list of the main things to consider before buying or selling.

It’s no secret the real estate market is in very bad shape right now. And in an effort to be as up-front as possible about the pros and cons, I wanted to create this quick list of the main things to consider before buying or selling.