We love having you here!

I’ve got 3 updates to share this month:

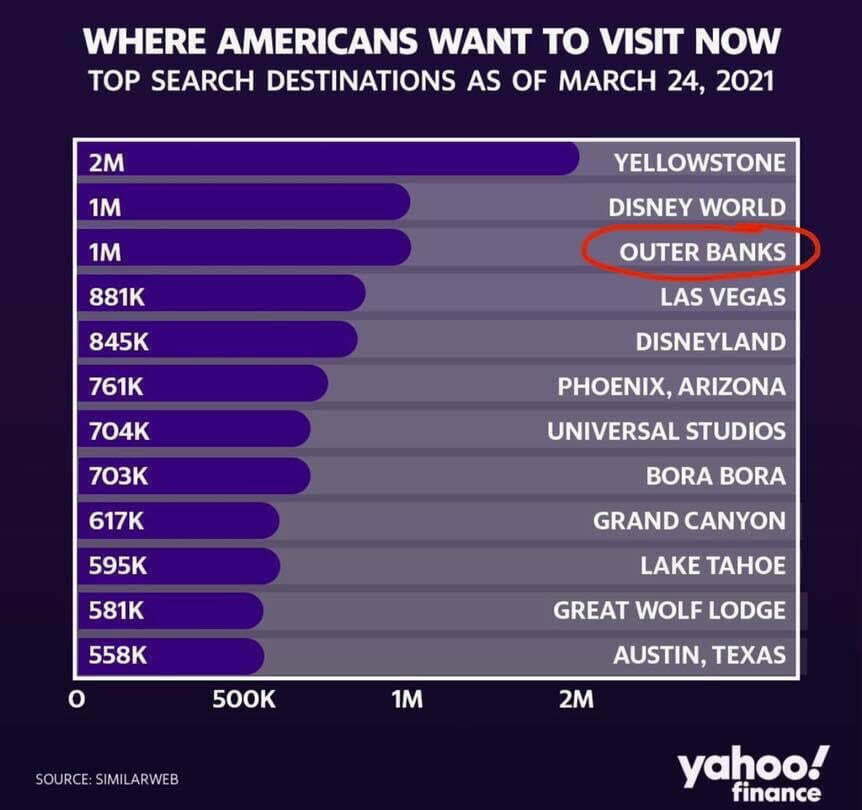

Outer Banks, NC Real Estate Resource

I’ve got 3 updates to share this month:

Although it sounds reasonable to think with all the guests coming, it would be better to just sell the home in the fall or spring, take a look at these 5 reasons you could be missing out by waiting.

Although it sounds reasonable to think with all the guests coming, it would be better to just sell the home in the fall or spring, take a look at these 5 reasons you could be missing out by waiting.

Happy April! I hope you had a wonderful Easter weekend. Beautiful weather has finally arrived at the beach.

I have a few interesting topics this month.

Here’s a quick snapshot of what we’re dealing with as we look at current active inventory versus what is currently under contract.

| Active | Under Contract | Sold so far 2021 | ||

| Corolla | 38 | 119 | 132 | |

| Duck | 22 | 15 | 40 | |

| Southern Shores | 10 | 22 | 28 | |

| Kitty Hawk | 8 | 22 | 31 | |

| Kill Devil Hills | 12 | 57 | 101 | |

| Nags Head | 31 | 50 | 82 | |

*Source OBAR MLS for single-family homes only

I’ve been selling since 1997, and I’ve never seen anything like this. It’s very exciting to have so many people this dedicated to buy their beach dream home. It’s also a very challenging market! Despite what it looks like, finding the buyer is a very small percentage of what an agent does for a seller. With increased regulations, rules, financing challenges, and buyer expectations, having a good agent on your side, truly is instrumental to getting the transaction closed. If you have any questions about buying or selling in this market, please contact me.

This month’s update is short and not so sweet. The market activity is still very strong and has not changed…yet.

Big BREAKING MORTGAGE NEWS in the last few days is regarding the purchase of 2nd homes. A new Treasury Amendment now limits Fannie Mae on the acquisition of single-family mortgage loans secured by the second home and investment properties to only 7%. As a result, this could equate to as much as a half-percent higher rate on these loans. Click here for the full article.

No market is immune to these kinds of changes. If you’re wanting to purchase on the OBX, the time is now! Of course, that means we need more inventory. If you’re thinking of selling and want a complete analysis of what your home is worth, contact me today!

Supply and demand. That’s the basic economic principle driving markets for decades. Here we are! Finally experiencing some movement in the northern beaches market, after the slowest recovery ever from the 2008 market crash.

Sellers – if you want to cash in – now is the perfect time! Condition is still important to maximize profits, so contact me before any repair work so we can make the most of your investment.

Buyers – be pre-qualified, ready to sign an offer, prepare to offer virtually, and be prepared to offer over asking price in many cases. You need someone scanning the new listings daily. Now is not the time to go unrepresented. Let me know if you’re looking!

Corolla

57 Active listings 108 Under Contract

Duck

23 Active listings 22 Under Contract

Southern Shores

15 Active listings 19 Under Contract

Kitty Hawk

6 Active listings 17 Under Contract

Kill Devil Hills

24 Active listings 65 Under Contract

Nags Head

38 Active listings 38 Under Contract

Now you can see what we are working with. Contact me if you have any questions about our current market.

I do predict it will last this way through the year.

We saw a lot of very positive signs in 2015 that continue to lead us on the path to recovery. While we still have an oversupply of inventory on the market, keeping prices down, we have a double digit increase in number of sales.

The other interesting trend is showing more homes in the higher price ranges are selling and fewer homes offered in the under $300,000 price range. That is showing our median sales price to be up, even though individual home prices aren’t rising at this point.

It’s virtually impossible for our home values to go up when inventory is still at a 15 month supply. However, it’s a great step forward. We saw a 20% increase in number of sales for 2012, then it steadied for 2 years until another big increase in sales for 2015.

Mortgage brokers are expecting a surge in activity the first part of 2016 to beat the Fed’s promise of rising interest rates. We certainly have a year round market on the OBX and see great activity all year long. The two spikes in activity happen in March/April and September/October. No need to wait though, we can get your home sold any time of year.

Here is the breakdown of where we ended up for 2015:

Next month I’ll provide a break down of each location individually so you can see how it compares year over year.

If you have any questions or would like additional information please let me know.

An interesting trend is popping up for the year so far. We have sold more homes, granted marginally, but for less volume. So, that means either we are selling fewer high end homes or prices are still going down.

Let’s look at the stats:

This tells us two things. Fewer high end homes are selling and fewer homes are available for sale under $200,000. The lower end price range is a no brainer. They will always sell regardless of the economy and market. It’s the beach, for less than $200,000! The bright spot is that those homes are seeing a bump in value. As things stabilize that price range will always be the first to jump. Great sign of improvement there.

However, high end home sales do indicate trends. To be fair, there was a $5,000,000 home sale in January of 2014 which is clearly skewing the numbers. Even so, there were 6 fewer high end homes that sold so far this year. And, there are more of them for sale than in 2014. So, that indicates a slow down in that market. I’m not quite sure of the cause, would love to hear your thoughts on this.

That covers the first challenge. The second challenge is that home prices above $300,000 are still dropping, even if just slightly. Consider these stats:

From Nags Head to Corolla:

Those are some sobering stats. My goal is never to be Debbie Downer, yet always look at true reality. Most homes are STILL having to adjust their price at least once in order to sell and there are still two times the number of homes coming on the market each month as are selling. It doesn’t take an economics major to tell you that is still a recipe for lower prices.

Same moral of the story as every month…if you want to sell, there is no financial gain to waiting it out short term. If you want to buy in the under $300,000 range, you’re going to face some competition among other buyers looking for the best deals. Let me know how I can help!

While the outside temperature may be at freezing right now for the Outer Banks, our market is smoking hot! Well at least when it comes to activity.

Chew on this – From Nags Head to Corolla, there were 98 homes that went under contract in January. Of those, 34 have been on the market for 60 days or less and 24 were on the market for 30 days or less.

That means 24 homes that JUST came on the market in December or January and are already under contract. Another great note, 6 of those 98 are deals I put together! I’ve been very busy so far this year and am working hard to keep it going.

Even though the data reports that closed transactions for January shows a 13% drop from January of 2014, that is really an indication of activity from November and December. It will be very interesting to see the difference in closed transactions for this February over last year.

So that covers activity…I know, you’re thinking about value and price now. Take a look at the chart below. While activity has had its ups and downs, price has really flat lined. That’s actually expected after a market crash as devastating as we had.

|

Year |

Units Sold | Percentage Change | Median Price | Percent Change | Active Listings | Median DOM | Months Supply |

|

2011 |

1,333 |

$284,500 |

|||||

|

2012 |

1,596 | 20% | $285,000 | 0% | 1726 | 226 |

12.98 |

|

2013 |

1,574 | -1% | $273,500 | -4% | 1714 | 222 |

13.07 |

| 2014 | 1,604 |

2% |

$280,000 | 2% | 1733 |

213 |

12.97 |

If you’re considering buying and found a house you love, take action before it sells!

If you’re thinking about selling, there’s NO reason to wait. Buyers are ready! Also keep in mind that we are a resort market. Most buyers and sellers don’t HAVE to buy or sell. It’s a discretionary purchase, so it’s normal for our market to take longer to recover.

4826 N Croatan Hwy

Kitty Hawk, NC 27949

Work: (252) 261-3815 Cell: (252) 619-5225

You will receive the most up to date Outer Banks news once a month like information on flood insurance, market stats and updates, bridge news, local happenings and more!