If we look at a recap of 2025, the story is small changes from 2024.

Take a look:

Category 1 – Closing Price

|

2024 |

2025 |

||

| Closed Full Price |

20.94% |

19.5% |

Down |

| Over List Price |

11.38% |

9.36% |

Down |

| Under List Price |

67.88% |

71.14% |

Up |

| Total # Sold |

2,206 |

2,190 |

Down |

Either sellers are getting more aggressive on pricing, or buyers are offering less overall.

Category 2 – Basic Activity comparing January 2025 to January 2026

|

2025 |

2026 |

|

| Status to U/C |

179 |

181 |

| Median DOM |

40 |

54 |

| New Listings |

328 |

297 |

| Price Changes |

190 |

196 |

| Total Sold |

162 |

153 |

| Median DOM |

65 |

38 |

Category 3 – Current Market Absorption comparing January 2025 to January 2026

|

2025 |

2026 |

|

| Active Homes |

568 |

529 |

| Under Contract |

246 |

256 |

| % of INV U/C |

18% |

19% |

| Absorption Rate |

5.9 |

5.5 |

If you would like to set an appointment to detail a plan for accomplishing your 2026 OBX real estate goals, let me know, and we will set something up!

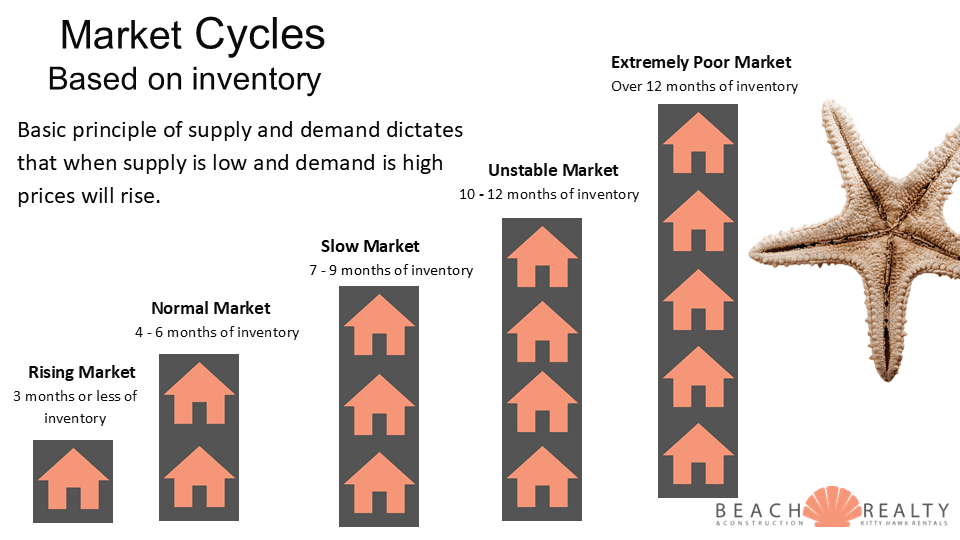

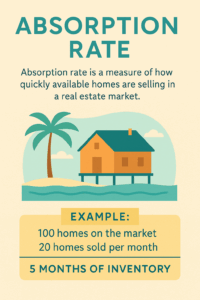

Absorption rate is a key real estate metric that shows how quickly available homes are selling in a specific market.

Absorption rate is a key real estate metric that shows how quickly available homes are selling in a specific market.

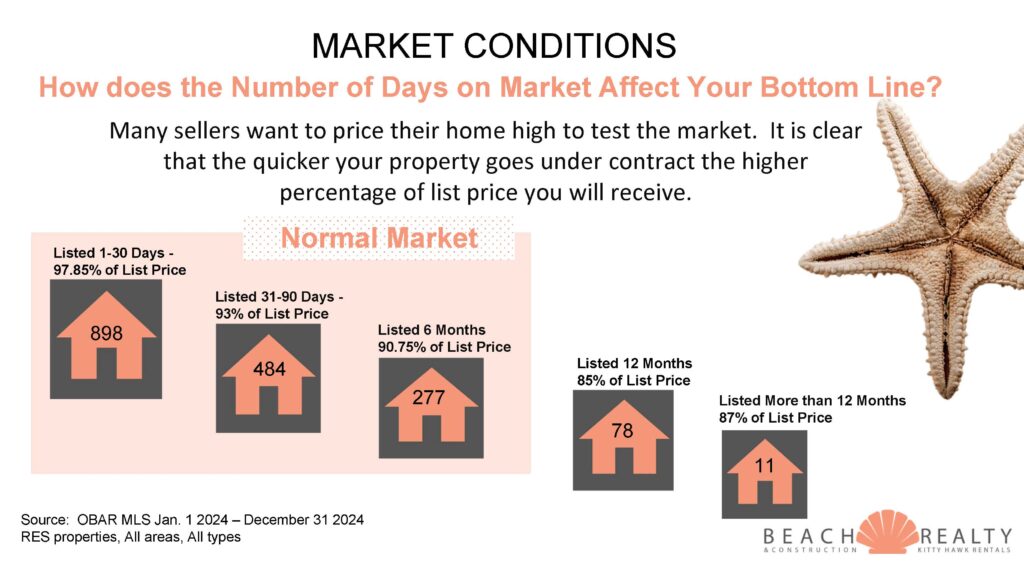

Now that we have 4 full months of data for 2025, let’s see how it compares to the same time last year. There are some noticeable changes to keep track of which is outlining the little by little deterioration of our current market.

Now that we have 4 full months of data for 2025, let’s see how it compares to the same time last year. There are some noticeable changes to keep track of which is outlining the little by little deterioration of our current market.