It’s that time of year again! Time to start planning those spring cleans and updates to get the house ready for the season. Below is a list of vendors I can personally verify to do a good job, show up, and charge a reasonable fee. Be sure to give them my name!!!

If you need a vendor not listed below, let me know!

Small Construction & Repair:

Landscaping:

Chase Patterson

Albemarle Landscapes

252-256-1883

[email protected]

Carpet Care/Upholstery Cleaning:

Steve Howard

Howards Flooring & Upholstery

252-305-2293

Painting:

Roofing:

Marion Gee

252-267-5110

Redecorating/Organizing/Staging:

Mortgage/Refinance:

Kelly Bergenstock

252-619-9037

[email protected]

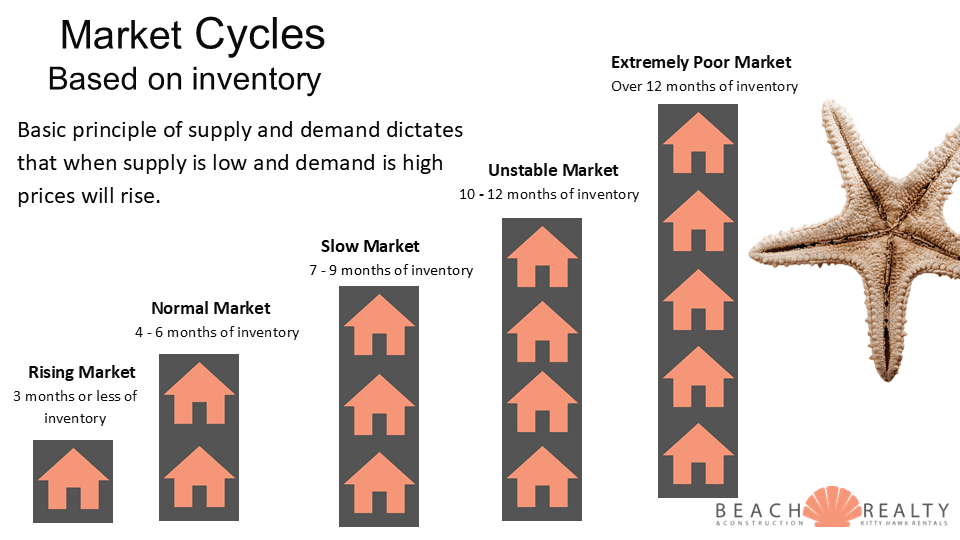

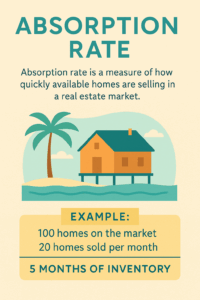

Absorption rate is a key real estate metric that shows how quickly available homes are selling in a specific market.

Absorption rate is a key real estate metric that shows how quickly available homes are selling in a specific market. Real estate markets across the country are definitely starting to crack. The northeast is really the last holdout and there are signs of a beginning surge in inventory there. With slowing activity and rising inventory, it looks like the OBX could enter a buyers market by the second quarter of next year.

Real estate markets across the country are definitely starting to crack. The northeast is really the last holdout and there are signs of a beginning surge in inventory there. With slowing activity and rising inventory, it looks like the OBX could enter a buyers market by the second quarter of next year.

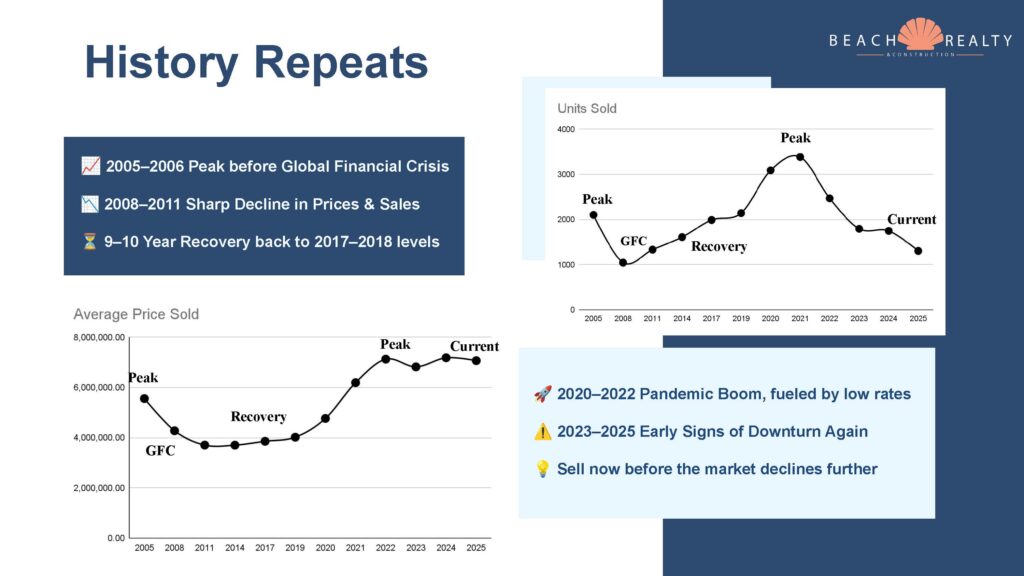

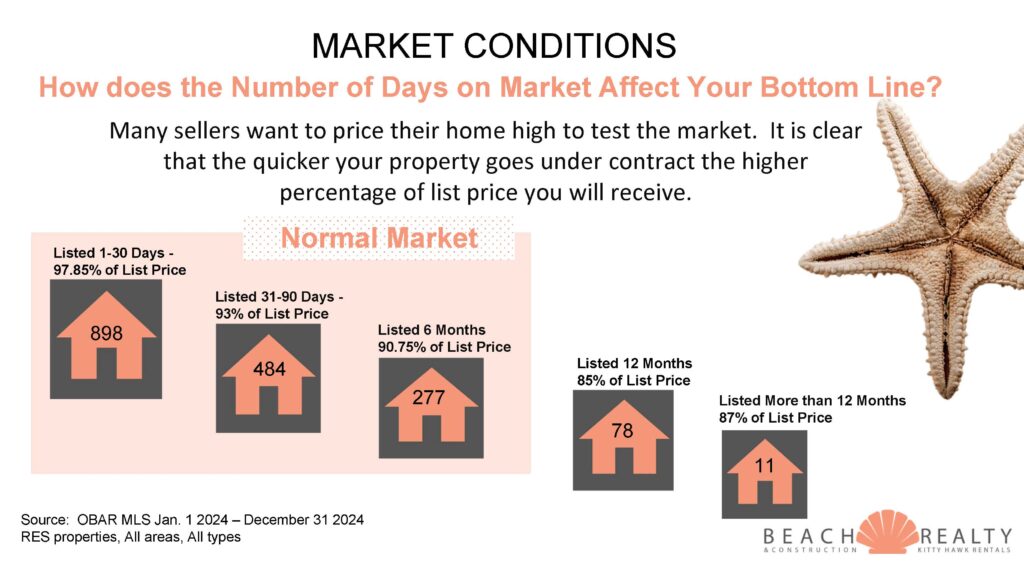

Now that we have 4 full months of data for 2025, let’s see how it compares to the same time last year. There are some noticeable changes to keep track of which is outlining the little by little deterioration of our current market.

Now that we have 4 full months of data for 2025, let’s see how it compares to the same time last year. There are some noticeable changes to keep track of which is outlining the little by little deterioration of our current market.