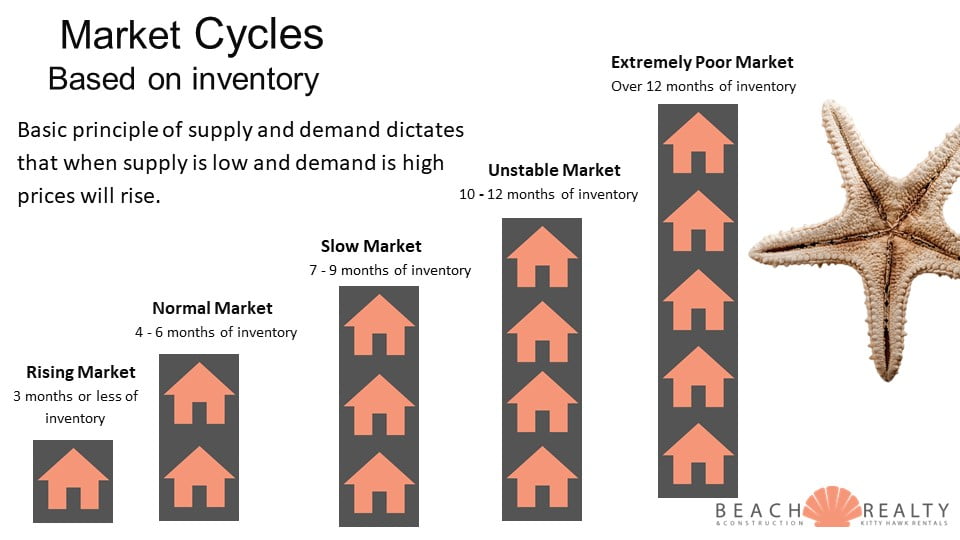

2024 market saw a few distinct changes. Higher inventory and massive price reductions. We are already starting to see a small change in pricing – roughly 5 – 7% depending on location. If inventory keeps rising, we could see the pricing change go up.

Here’s how December Year over Year looks:

|

December 2024 |

December 2025 |

|

| Active – 585 | Active – 434 | *Single Family |

| U/C – 244 | U/C – 235 | *All Classes |

| Absorption Rate – 6.59 | Absorption Rate – 4.89 |

As you can see inventory is up 35%.

Yet the number of properties under contract is about the same. While that number has not gone down, what happens when you have more homes for sale and the same or fewer buyers? Law of supply and demand is in play. That is why the absorption rate (months of inventory) has gone up so much.

The statistics are telling us the slow down will continue this year. With mortgage rates higher and mortgage applications at their lowest levels ever, we could see a double-digit drop in pricing this year. I’ll be watching!

You may have heard in the news about the NAR Settlement, and there was a lot of bad information floating around. Having been licensed in NC since 1997, teaching the real estate license law for 15 years, and a member of the Board of Directors for the Outer Banks Association of Realtors, I’m bringing a snapshot of what to expect as we approach the implementation date on August 17th.

You may have heard in the news about the NAR Settlement, and there was a lot of bad information floating around. Having been licensed in NC since 1997, teaching the real estate license law for 15 years, and a member of the Board of Directors for the Outer Banks Association of Realtors, I’m bringing a snapshot of what to expect as we approach the implementation date on August 17th. As we approach the second half of the year, it’s important to notice the little shifts happening along the way. Remember, real estate markets don’t crash overnight. It happens slowly at first, then all of a sudden. We are in the slowly at first phase.

As we approach the second half of the year, it’s important to notice the little shifts happening along the way. Remember, real estate markets don’t crash overnight. It happens slowly at first, then all of a sudden. We are in the slowly at first phase. In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see!

In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see! What a difference a year makes! Long story short, there are some BIG moves that are happening. I’ve talked before about algorithmic decay. This chart here is exactly that! Little, by little, by little, then bang. That’s how markets change. Tale as old as time, song as old as rhyme, it’s almost as good as a crystal ball.

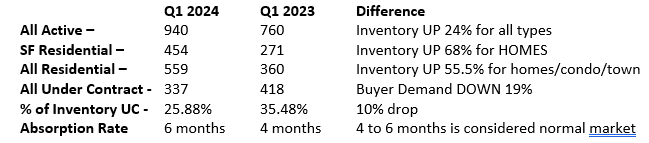

What a difference a year makes! Long story short, there are some BIG moves that are happening. I’ve talked before about algorithmic decay. This chart here is exactly that! Little, by little, by little, then bang. That’s how markets change. Tale as old as time, song as old as rhyme, it’s almost as good as a crystal ball.

A lot of agents will do presentations on how they came up with a price for your home. It is a task that does require some skill. The challenge of course is getting the seller to agree to the pricing suggestions.

A lot of agents will do presentations on how they came up with a price for your home. It is a task that does require some skill. The challenge of course is getting the seller to agree to the pricing suggestions. From what I have been told, there were many meetings amongst lots of organizations, Homebuilders Association and NC Realtors are included in the reshaping of the wastewater regulations. Negotiations were settled, the meeting concluded, and everyone went home. The night before the vote, the bill is sent out. Unbeknownst to all signings, changes were made in favor of the Septic Tank Association’s lobbyists, resulting in the incoming “shituation” we have now. This DID come from the private sector and the only way out of it is legislatively.

From what I have been told, there were many meetings amongst lots of organizations, Homebuilders Association and NC Realtors are included in the reshaping of the wastewater regulations. Negotiations were settled, the meeting concluded, and everyone went home. The night before the vote, the bill is sent out. Unbeknownst to all signings, changes were made in favor of the Septic Tank Association’s lobbyists, resulting in the incoming “shituation” we have now. This DID come from the private sector and the only way out of it is legislatively.