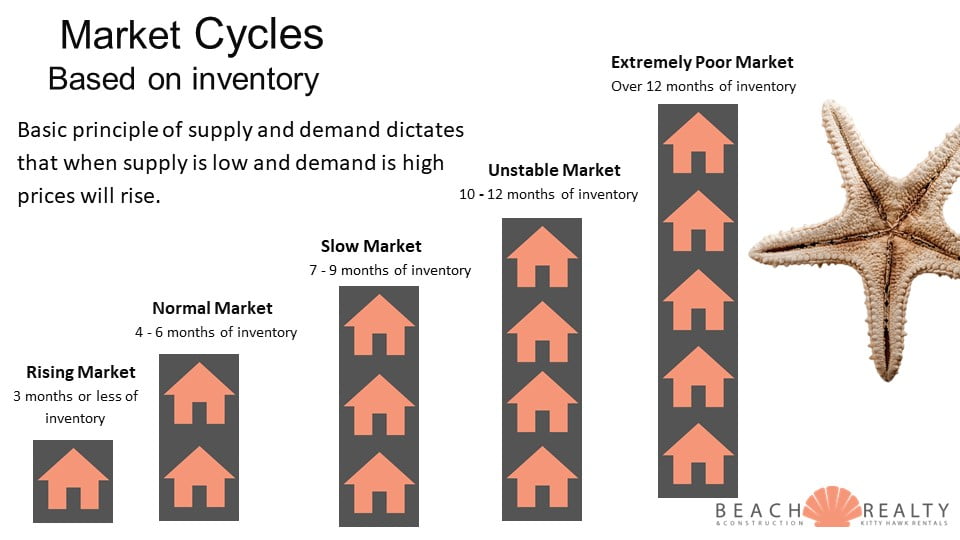

With the latest news of the DC and Metro housing market, it is yet to be seen if or how that may trickle down to the OBX. A healthy percentage of our secondary homeowners live in that area. It would only take a 20% increase in our inventory, if buyer demand stays the same, to push us into a 9 month absorption rate. That would then put us on the verge of an unstable market. We need to keep a close eye on how this will affect us.

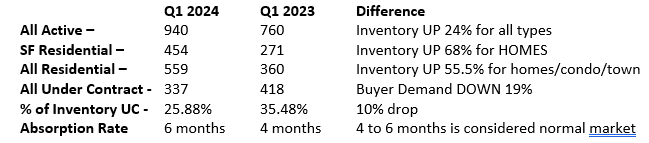

As for our latest stats, here’s what is happening:

| Mid February 2025 | Mid February 2024 | |

| Active All | 1,153 | 889 |

| Active Houses | 586 | 411 |

| Under Contract | 287 | 331 |

| 3 Mo Sold Avg | 155 | 147 |

| Absorp Rate | 7.4 | 5.9 |

The numbers speak for themselves. Inventory is up, activity is down. We are seeing 75% of properties selling under list price. This is indicative of a normal market. We have only a small window of excess inventory before we enter “unstable” territory.

If you’re on the fence about selling, you might want to take a closer look.

You may have heard in the news about the NAR Settlement, and there was a lot of bad information floating around. Having been licensed in NC since 1997, teaching the real estate license law for 15 years, and a member of the Board of Directors for the Outer Banks Association of Realtors, I’m bringing a snapshot of what to expect as we approach the implementation date on August 17th.

You may have heard in the news about the NAR Settlement, and there was a lot of bad information floating around. Having been licensed in NC since 1997, teaching the real estate license law for 15 years, and a member of the Board of Directors for the Outer Banks Association of Realtors, I’m bringing a snapshot of what to expect as we approach the implementation date on August 17th. As we approach the second half of the year, it’s important to notice the little shifts happening along the way. Remember, real estate markets don’t crash overnight. It happens slowly at first, then all of a sudden. We are in the slowly at first phase.

As we approach the second half of the year, it’s important to notice the little shifts happening along the way. Remember, real estate markets don’t crash overnight. It happens slowly at first, then all of a sudden. We are in the slowly at first phase. In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see!

In a nutshell, the market here is changing…slowly…but surely. These types of cycle shifts don’t happen all at once. Fortunately, because I study the market every day, I can help you see it coming. After all, you can get out of the way of what you don’t see! What a difference a year makes! Long story short, there are some BIG moves that are happening. I’ve talked before about algorithmic decay. This chart here is exactly that! Little, by little, by little, then bang. That’s how markets change. Tale as old as time, song as old as rhyme, it’s almost as good as a crystal ball.

What a difference a year makes! Long story short, there are some BIG moves that are happening. I’ve talked before about algorithmic decay. This chart here is exactly that! Little, by little, by little, then bang. That’s how markets change. Tale as old as time, song as old as rhyme, it’s almost as good as a crystal ball.