Absorption rate is a key real estate metric that shows how quickly available homes are selling in a specific market.

Absorption rate is a key real estate metric that shows how quickly available homes are selling in a specific market.

It’s calculated by taking the number of homes sold and comparing it to the total number of homes currently for sale.

How to use the number:

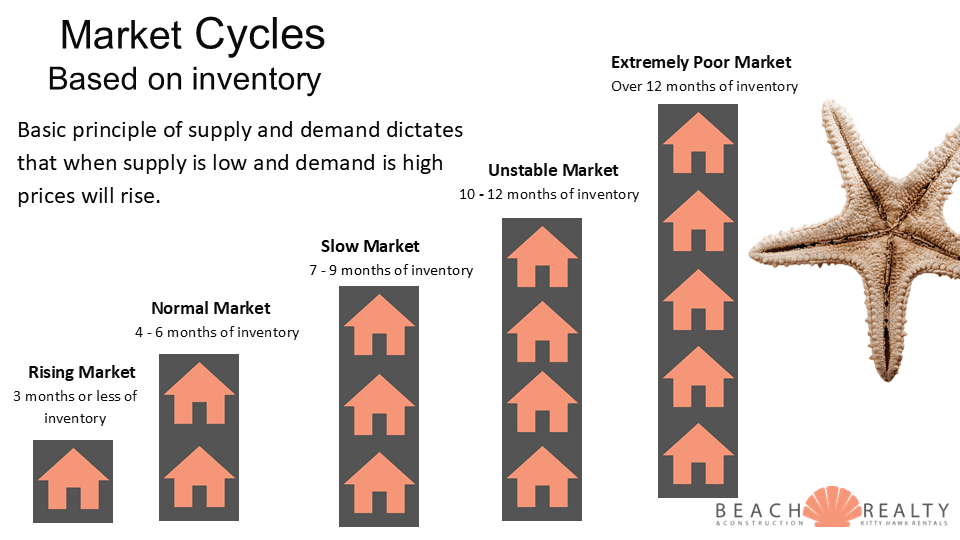

- 0–3 months → 🔥 Seller’s Market (homes selling quickly)

- 4–6 months → ⚖️ Balanced Market

- 7+ months → 🧊 Buyer’s Market (homes sitting longer)

See how each town compares here:

| Corolla | Duck | S. Shores | Kitty Hawk | KDH | Nags Head | ||||||

| Active – | 145 | 32 | 18 | 30 | 100 | 62 | |||||

| Sold/Month – | 17.8 | 7.3 | 7.8 | 7.1 | 21.8 | 14.9 | |||||

| Abspt Rate – in months |

8 months |

5 months |

2.5 months |

4 months |

4.7 months |

4 months |

|||||

| *NL/Month | 37 | 11 | 3 | 9 | 42 | 13 |

(*NL/Month = New listings each month)

We know a market is shifting when the Absorption rate goes over 6 AND the number of new listings each month far exceeds the number selling each month. We are watching Corolla and Kill Devil Hills closely right now.

Real estate markets across the country are definitely starting to crack. The northeast is really the last holdout and there are signs of a beginning surge in inventory there. With slowing activity and rising inventory, it looks like the OBX could enter a buyers market by the second quarter of next year.

Real estate markets across the country are definitely starting to crack. The northeast is really the last holdout and there are signs of a beginning surge in inventory there. With slowing activity and rising inventory, it looks like the OBX could enter a buyers market by the second quarter of next year.

Now that we have 4 full months of data for 2025, let’s see how it compares to the same time last year. There are some noticeable changes to keep track of which is outlining the little by little deterioration of our current market.

Now that we have 4 full months of data for 2025, let’s see how it compares to the same time last year. There are some noticeable changes to keep track of which is outlining the little by little deterioration of our current market.

You may have heard in the news about the NAR Settlement, and there was a lot of bad information floating around. Having been licensed in NC since 1997, teaching the real estate license law for 15 years, and a member of the Board of Directors for the Outer Banks Association of Realtors, I’m bringing a snapshot of what to expect as we approach the implementation date on August 17th.

You may have heard in the news about the NAR Settlement, and there was a lot of bad information floating around. Having been licensed in NC since 1997, teaching the real estate license law for 15 years, and a member of the Board of Directors for the Outer Banks Association of Realtors, I’m bringing a snapshot of what to expect as we approach the implementation date on August 17th.