Now that we have almost three quarters to look at, let’s check in on how the market is

performing.

- Overall – Residential Inventory is up 12% from last year

- Sales for residential homes remain unchanged

- Median Sales price for residential homes also remains the same

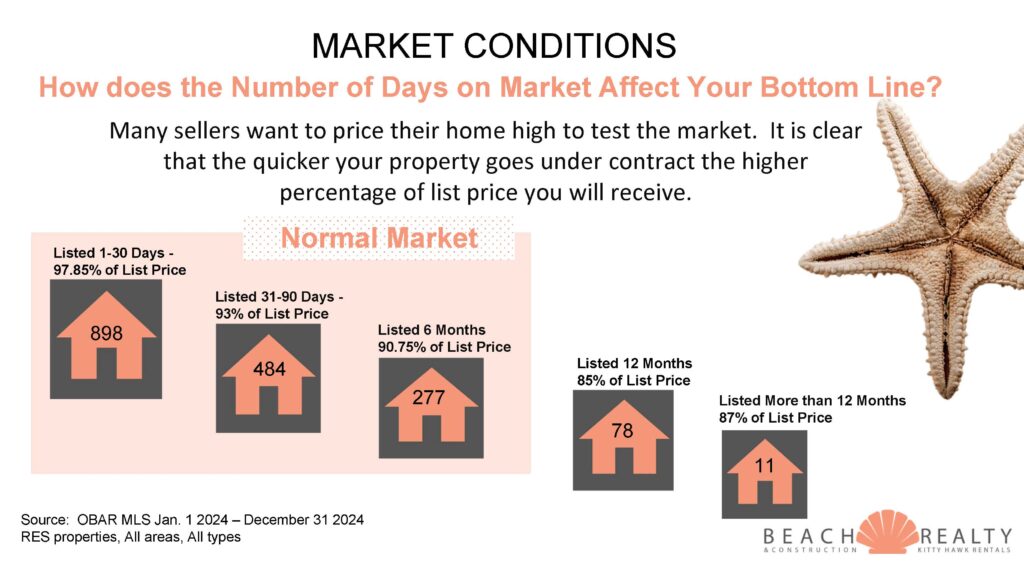

This means inventory has gone up, but the buyer demand has stayed the same. Right now we

have a 6 month absorption rate, which puts us in what is considered a “Normal Market”. This

means there’s no obvious advantage for the buyer or seller. However, if the inventory

continues to creep up and demand remains the same or drops, that will put us into the next

category “Slow Market” which is the beginning of a buyer’s market. If you’re on the fence

about selling, why not take advantage of the current market conditions?

Let’s break it down by town:

| Corolla | Southern Shores |

| Sales – Down 29% | Sales – Down 5% |

| Price – Down 7% | Price – Unchanged |

| Duck | Kitty Hawk |

| Sales – Up 3% | Sales – Up 3% |

| Price – Down 2% | Price – Up 4% |

| Kill Devil Hills | Nags Head |

| Sales – Down 7% | Sales – Up 37% |

| Price – Up 3% | Price – Down 14% |

Overall, we are seeing more homes for sale under $500,000 and fewer homes selling over

$2Million. This is the tipping point. The real estate market doesn’t crash overnight. It goes

little by little. We are in the beginning phase, and price correction is continuing to happen due

to all-time low affordability.

A record number of 32% of all mortgage applications are being denied. Considering the

number of applications is historically low anyway, the writing is on the wall for impending

changes to our market. As a resort market, we are always 12 months or more behind the

curve.

To strategize for your best move in achieving real estate goals contact me for a private

consultation!

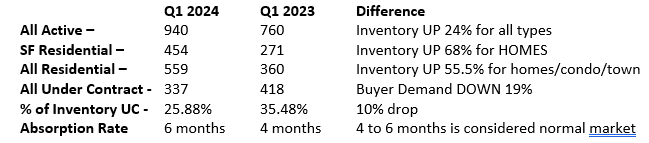

What a difference a year makes! Long story short, there are some BIG moves that are happening. I’ve talked before about algorithmic decay. This chart here is exactly that! Little, by little, by little, then bang. That’s how markets change. Tale as old as time, song as old as rhyme, it’s almost as good as a crystal ball.

What a difference a year makes! Long story short, there are some BIG moves that are happening. I’ve talked before about algorithmic decay. This chart here is exactly that! Little, by little, by little, then bang. That’s how markets change. Tale as old as time, song as old as rhyme, it’s almost as good as a crystal ball.

With all the insurance and septic news, I’m going to be brief on this month’s market report and just give you the numbers straight up. With only one month in, there isn’t a lot to analyze anyway.

With all the insurance and septic news, I’m going to be brief on this month’s market report and just give you the numbers straight up. With only one month in, there isn’t a lot to analyze anyway. History repeats itself. A saying I’m sure you’ve heard and said dozens of times. I might not yet be a half of a century old, but I’m old enough, and have been in this business long enough (27 years) to recognize a similar pattern. Let’s revisit the timeline of the Outer Banks real estate market from the year 2000.

History repeats itself. A saying I’m sure you’ve heard and said dozens of times. I might not yet be a half of a century old, but I’m old enough, and have been in this business long enough (27 years) to recognize a similar pattern. Let’s revisit the timeline of the Outer Banks real estate market from the year 2000. What a mild winter we have had here at the beach so far. We are not complaining, that’s for sure.

What a mild winter we have had here at the beach so far. We are not complaining, that’s for sure.