It’s still 70 degrees here in Corolla today! Almost mid November and it’s very warm. Also SMOKING HOT is real estate market activity! Pending sales are up 56% from last year. That means there are more properties under contract right now than this same time last year.

However, most importantly to note, prices are NOT up. In fact in some markets, like Corolla, they have still declined. Other areas remain virtually unchanged. So we are selling more houses for the same or less money. That’s not a terrible thing, because it means we are stabilizing. That’s a good sign, since it’s a necessary part of a recovery.

Let’s remember, the majority of home sales on the Outer Banks are to buyers who don’t live here. That means it is a discretionary purchase, which will cause our recovery to naturally be slower than those year round markets. This is nothing new. The same thing happened when the real estate market crashed in the late 80’s. It was almost 1999 before things recovered.

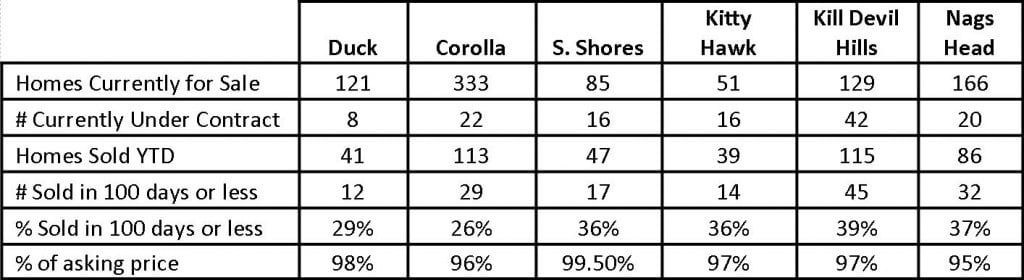

Distressed property sales are down 30% from last year. So the truth is those sales are no longer a factor and are certainly not what’s holding back prices. The main issue is STILL supply and demand. We have a whopping 16 months worth of inventory on the market right now.

That means if nothing new came on the market it would take 16 months to sell out what’s currently for sale. A normal market is considered to be a 4 to 6 month supply. Since we are selling more than last year and this “16 months” is the lowest absorption rate we’ve seen in many years, I would say this is another great sign that we are getting close to the end of the stagnant time.

The important thing to remember is, prices won’t immediately start to go up either. Appreciation takes time. So if your home is worth 15% to 20% less than what you would prefer to sell it for in today’s market, you could still be another 6 or more years away from getting your preferred price. And we don’t know what an interest rate hike could do to that time frame either. That kind of increase in value will take time, as it should, or we will only be setting ourselves up for another crash. Which I’m sure, nobody wants to experience again this soon if at all!

That being said, if you want to buy a great house, it may not last long. Especially if the home is priced right. If you want to sell your home, price it aggressively and the buyers will show up!