2015 Mid Year Outer Banks Market Report

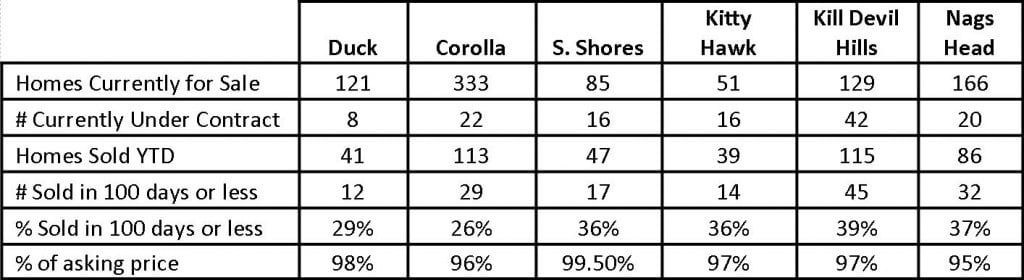

We now have 6 months worth of data in and the results are pretty much what we expected for the real estate market performance. Here are the bullet points:

- Up in NUMBER of sales by 9%

- Down in average sale PRICE by 8%

- Numerous homes in each market are selling in less than 100 days

- Of the homes selling quickly, it’s just a few % points of asking price

- Distress inventory is less than 5%

- Active inventory on the OBX remains over 3,000 listings

- 10% of active inventory is under contract, which means 90% is NOT

Here’s a quick breakdown by marketplace:

NOTE: The days reported INCLUDES the time it took to close the transaction, which is generally 35 to 50 days.

The good news is, if you price it right, it will sell! Buyers are looking and ready for the best values and aren’t afraid to take action.

If you’d like more information about buying or selling on the Outer Banks, please contact me right away!

Contact Me Today!

June Market Update

This month let’s take a look at what’s happening in each specific location for a closer, more in depth view understanding.

Corolla

| Corolla Stats | |

| Total # of Homes for Sale | 377 |

| Total # Selling per month | 17 |

| Months of remaining Inventory | 22 |

| # of New listings each month | 45 |

Corolla has a 22 month supply of inventory. It’s the weakest market on the Outer Banks right now in terms of supply and demand. Constant price reductions are needed to get homes sold. When a home comes on the market priced well, it will sell quickly.

Duck

| Duck Stats | |

| Total # of Homes for Sale | 154 |

| Total # Selling per month | 8 |

| Months of remaining Inventory | 19 |

| # of New listings each month | 18 |

One great trend in Duck is that the supply of homes under $300,000 is very diminished. While the inventory issue is still a problem for Duck, homes will sell very fast when priced for the market.

Southern Shores

| Southern Shores Stats | |

| Total # of Homes for Sale | 93 |

| Total # Selling per month | 7 |

| Months of remaining Inventory | 13 |

| # of New listings each month | 20 |

The Southern Shores market is doing quite well. It has one of the lowest inventory levels of all the towns. Land sales are fantastic in Southern Shores right now.

Kitty Hawk

| Kitty Hawk Stats | |

| Total # of Homes for Sale | 77 |

| Total # Selling per month | 13 |

| Months of remaining Inventory | 22 |

| # of New listings each month | 19 |

Kitty Hawk between the highways is a fast seller right now. Those homes are a fantastic value and buyers are recognizing that.

Kill Devil Hills

| Kill Devil Hills Stats | |

| Total # of Homes for Sale | 182 |

| Total # Selling per month | 19 |

| Months of remaining Inventory | 9.5 |

| # of New listings each month | 40 |

By far the most stable market on the Outer Banks right now is Kill Devil Hills. Keep in mind the majority of homes selling here are under $300,000. This area has the best supply and demand situation of all the towns.

Nags Head

| Nags Head Stats | |

| Total # of Homes for Sale | 190 |

| Total # Selling per month | 14 |

| Months of remaining Inventory | 13.5 |

| # of New listings each month | 25 |

Nags Head is holding it’s own right now. The average price there is $350,000 which makes it super affordable for such a great location.

So as you can see, right now selling a home on the Outer Banks comes solely down to price and condition. Buyers still have too many choices for prices to change any time soon. The good news is we have steady activity in the marketplace right now and it doesn’t seem to be slowing down.

If you’d like more information about buying

or selling a home on the Outer Banks, just let me know how I can help you.

March Outer Banks Market Update

An interesting trend is popping up for the year so far. We have sold more homes, granted marginally, but for less volume. So, that means either we are selling fewer high end homes or prices are still going down.

My thoughts are, a little bit of both.

Let’s look at the stats:

- 2014 – 16 homes sold over $750,000

- 2015 – 10 homes sold over $750,000

- 2014 – 58 homes sold under $200,000

- 2015 – 49 homes sold under $200,000

This tells us two things. Fewer high end homes are selling and fewer homes are available for sale under $200,000. The lower end price range is a no brainer. They will always sell regardless of the economy and market. It’s the beach, for less than $200,000! The bright spot is that those homes are seeing a bump in value. As things stabilize that price range will always be the first to jump. Great sign of improvement there.

However, high end home sales do indicate trends. To be fair, there was a $5,000,000 home sale in January of 2014 which is clearly skewing the numbers. Even so, there were 6 fewer high end homes that sold so far this year. And, there are more of them for sale than in 2014. So, that indicates a slow down in that market. I’m not quite sure of the cause, would love to hear your thoughts on this.

That covers the first challenge. The second challenge is that home prices above $300,000 are still dropping, even if just slightly. Consider these stats:

From Nags Head to Corolla:

- In the last 30 days – 205 homes had a price reduction

- In the last 30 days – 249 new homes came on the market

- In the last 30 days – 127 homes sold

Those are some sobering stats. My goal is never to be Debbie Downer, yet always look at true reality. Most homes are STILL having to adjust their price at least once in order to sell and there are still two times the number of homes coming on the market each month as are selling. It doesn’t take an economics major to tell you that is still a recipe for lower prices.

Same moral of the story as every month…if you want to sell, there is no financial gain to waiting it out short term. If you want to buy in the under $300,000 range, you’re going to face some competition among other buyers looking for the best deals. Let me know how I can help!

New Listing! 3104 Columbia Avenue Kill Devil Hills, NC 27948

New Listing!!

New Listing!!

3104 Columbia Avenue

Kill Devil Hills, NC

MLS# 87201 $240,000

This charming beach box is located in a prime area in Kill Devil Hills. The garage was converted to a work area/laundry room/game area and additional bedroom with private bathroom. Take the interior stairs up to an open great room with kitchen and dining area. Two additional bedrooms are on the south side of the top floor with a hall bath. A large master bedroom and bath with walk in closet are on the north side. The fenced in back yard makes this a great choice for buyers with dogs or small kids. Plenty of room to play. Maintenance free vinyl siding is a plus!

Contact me for more details!

Vendor List

It’s that time of year again! Time to start planning those spring cleans and updates to get the house ready for the season. Below is a list of vendors I can personally verify to do a good job, show up and charge a reasonable fee. Be sure to give them my name!!!

If you need a vendor not listed below, let me know!

Small Construction & Repair:

Lee Clark

252-305-5017

[email protected]

Joe Foti

Goodfellas Property Services

252-573-8946

[email protected]

Steve McCauley

252-202-5270

ReliablePropertyMgt@gmail.com

Landscaping:

Chase Patterson

Albemarle Landscapes

252-256-1883

[email protected]

Jason Woodard

Green Gator Lawn Care

252-204-1537

[email protected]

Carpet Care/Upholstery Cleaning:

Steve Howard

Howards Flooring & Upholstery

252-305-2293

Painting:

Roofing:

Marion Gee

252-267-5110

Redecorating/Organizing/Staging:

Amy Hilliker Klebitz

Certified Interior Design

910-297-8566

[email protected]

www.amyklebitz.com

Refinance:

Drew Wright

Citizens One

252-256-2018 [email protected]

Ilona Matteson’s 2015 Outer Banks Real Estate Market

Happy New Year!

I’m Ilona Matteson with Beach Realty on the Outer Banks.

I’m very excited about 2015. This will be my 19th year in the real estate business and boy have things changed since I started back in 1996.

A few predictions for the Outer Banks market this year are:

- All financial experts are saying that we will see interest rates go up this year. They’ve said it before and even though rates are still in the 4% range, that is up from the best rates we had at 2 and 3%.

- Condition will continue to be the number one factor for buyers. I’ve seen buyers time and again bypass location to get a home in better condition at a lower price.

- Prices will continue to stay where they are because of extraordinarily high inventory rates. Right now we have a 20 month supply of homes for sale on the Outer Banks. The basic principle of supply and demand dictates that prices cannot rise in conditions like this and, they could still see some slight decreases.

- Most homes will take on average over 200 days on the market to sell. That’s mainly because they will go through 2 to 3 price adjustments before selling. If you’re going to put your home on the market in 2015, you have to be competitively priced if you want to sell quickly.

- I predict that we will see more properties sell this year. I think buyers will act before interest rates go up again.

If you have any plans to buy or sell on the Outer Banks this year, or know anyone who is, please let me know how I can help you.

My goal is to assist 40 buyers and sellers this year, and I hope you’ll be one of them!