If we look at a recap of 2025, the story is small changes from 2024.

Take a look:

Category 1 – Closing Price

|

2024 |

2025 |

||

| Closed Full Price |

20.94% |

19.5% |

Down |

| Over List Price |

11.38% |

9.36% |

Down |

| Under List Price |

67.88% |

71.14% |

Up |

| Total # Sold |

2,206 |

2,190 |

Down |

Either sellers are getting more aggressive on pricing, or buyers are offering less overall.

Category 2 – Basic Activity comparing January 2025 to January 2026

|

2025 |

2026 |

|

| Status to U/C |

179 |

181 |

| Median DOM |

40 |

54 |

| New Listings |

328 |

297 |

| Price Changes |

190 |

196 |

| Total Sold |

162 |

153 |

| Median DOM |

65 |

38 |

Category 3 – Current Market Absorption comparing January 2025 to January 2026

|

2025 |

2026 |

|

| Active Homes |

568 |

529 |

| Under Contract |

246 |

256 |

| % of INV U/C |

18% |

19% |

| Absorption Rate |

5.9 |

5.5 |

If you would like to set an appointment to detail a plan for accomplishing your 2026 OBX real estate goals, let me know, and we will set something up!

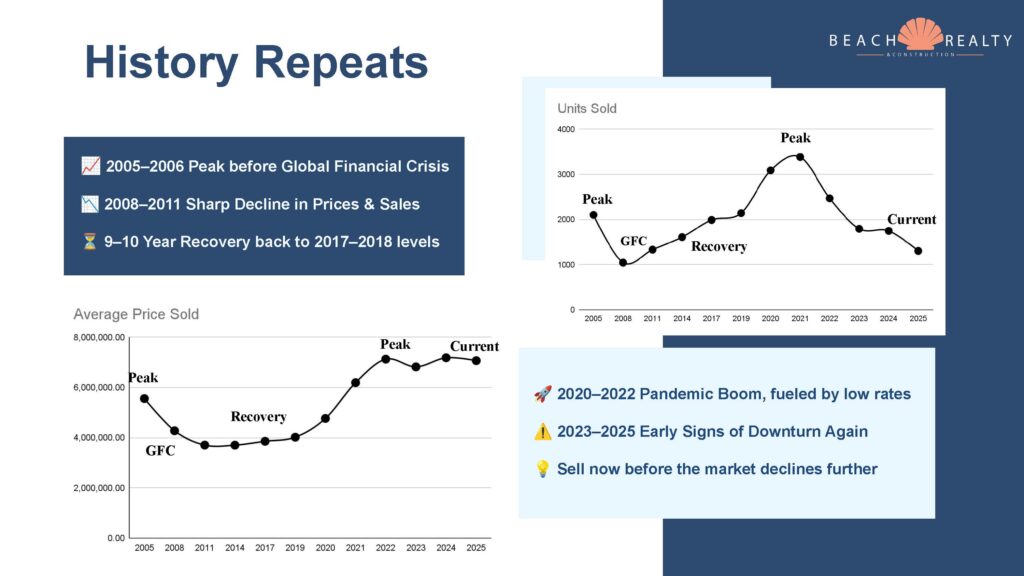

Real estate markets across the country are definitely starting to crack. The northeast is really the last holdout and there are signs of a beginning surge in inventory there. With slowing activity and rising inventory, it looks like the OBX could enter a buyers market by the second quarter of next year.

Real estate markets across the country are definitely starting to crack. The northeast is really the last holdout and there are signs of a beginning surge in inventory there. With slowing activity and rising inventory, it looks like the OBX could enter a buyers market by the second quarter of next year.