Happy Mid-March!

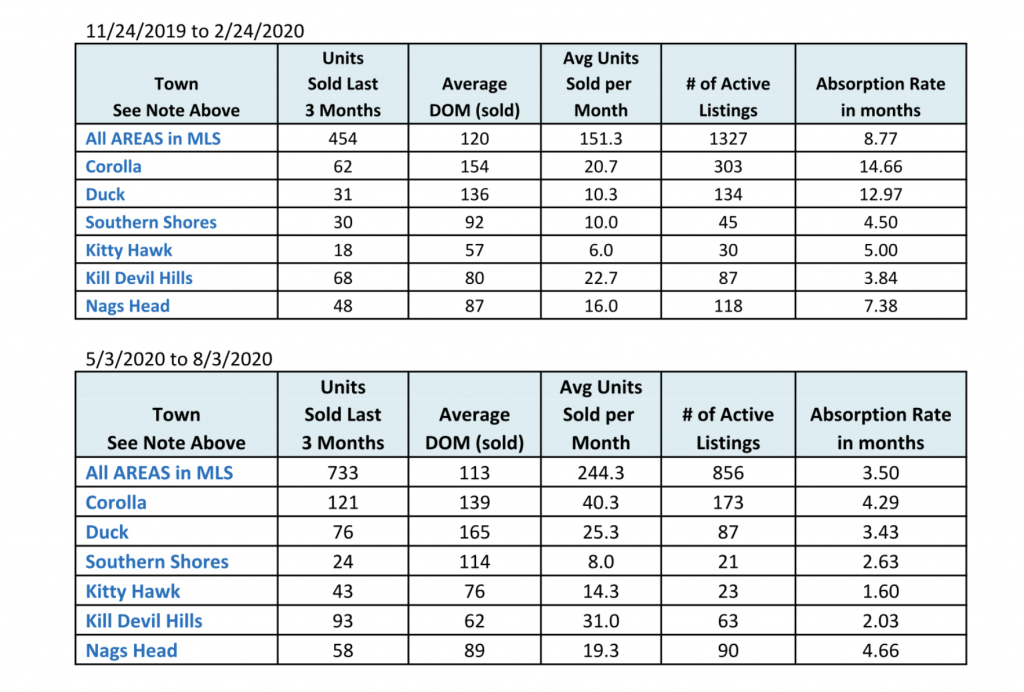

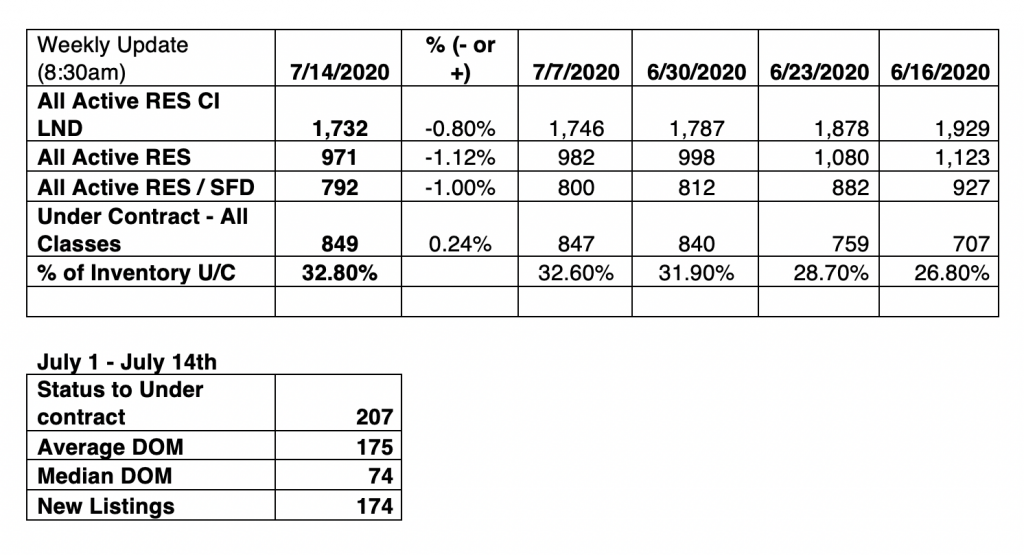

This month’s update is short and not so sweet. The market activity is still very strong and has not changed…yet.

Big BREAKING MORTGAGE NEWS in the last few days is regarding the purchase of 2nd homes. A new Treasury Amendment now limits Fannie Mae on the acquisition of single-family mortgage loans secured by the second home and investment properties to only 7%. As a result, this could equate to as much as a half-percent higher rate on these loans. Click here for the full article.

No market is immune to these kinds of changes. If you’re wanting to purchase on the OBX, the time is now! Of course, that means we need more inventory. If you’re thinking of selling and want a complete analysis of what your home is worth, contact me today!

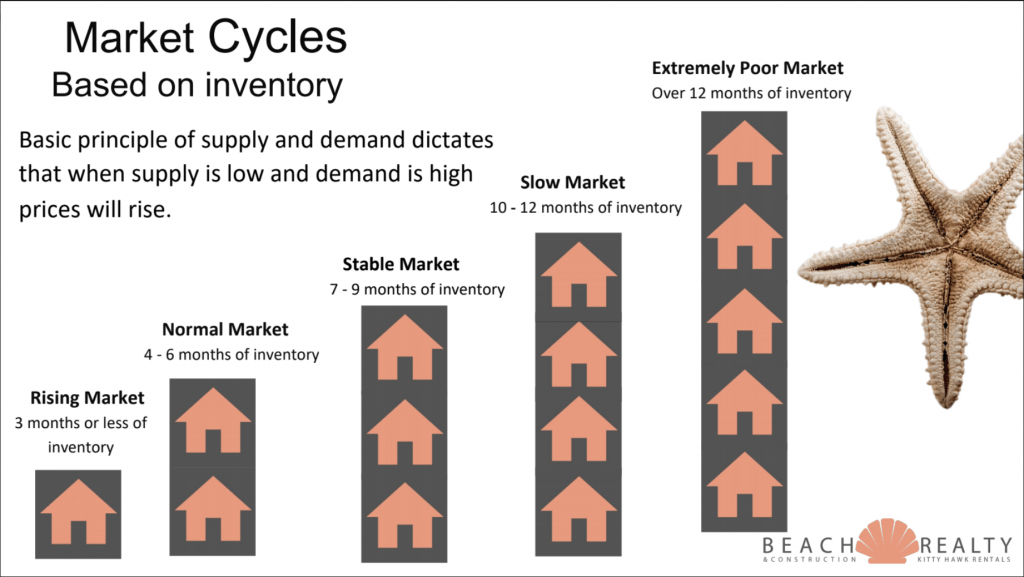

It’s no secret the real estate market on the Outer Banks is shifting. Even as we move into a seller’s market, keep in mind a majority of our home sales are secondary homes. This means more than 50% of our home buyers will spend up to 2 years searching for the right home. They can do that because they aren’t physically moving into the home.

It’s no secret the real estate market on the Outer Banks is shifting. Even as we move into a seller’s market, keep in mind a majority of our home sales are secondary homes. This means more than 50% of our home buyers will spend up to 2 years searching for the right home. They can do that because they aren’t physically moving into the home.