We love having you here!

I’ve got 3 updates to share this month:

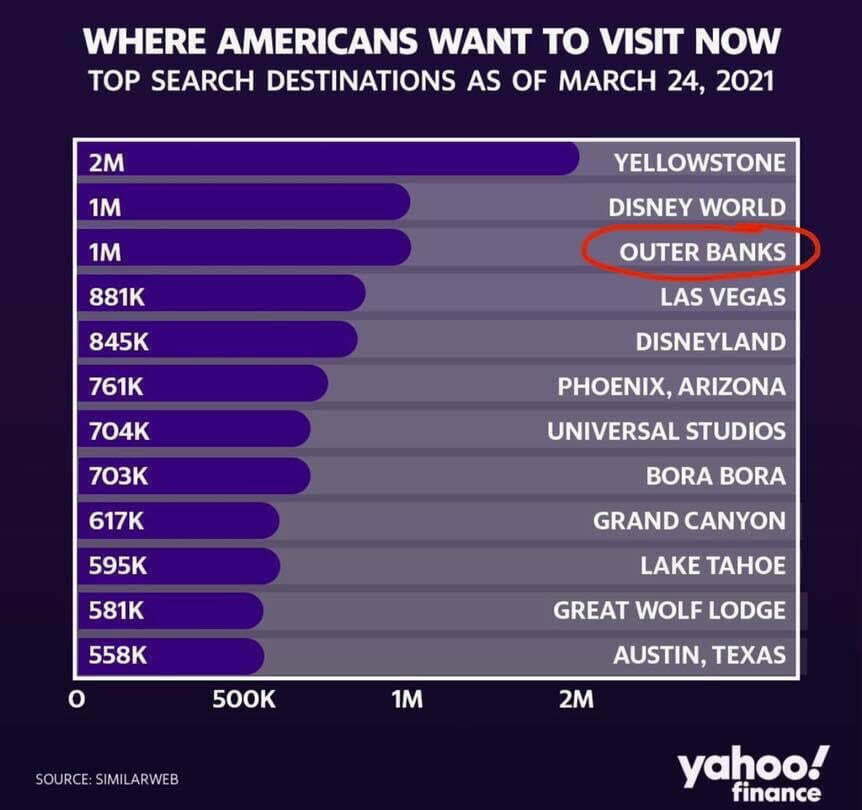

Outer Banks, NC Real Estate Resource

I’ve got 3 updates to share this month:

Although it sounds reasonable to think with all the guests coming, it would be better to just sell the home in the fall or spring, take a look at these 5 reasons you could be missing out by waiting.

Although it sounds reasonable to think with all the guests coming, it would be better to just sell the home in the fall or spring, take a look at these 5 reasons you could be missing out by waiting.

Happy April! I hope you had a wonderful Easter weekend. Beautiful weather has finally arrived at the beach.

I have a few interesting topics this month.

As part of my continued effort to provide you with the most relevant information, I wanted to reach out with some important updates regarding insurance for your Outer Banks investment. These changes primarily involve Frontline Insurance, which is considered one of the most affordable companies available.

If you are considering selling or buying, be mindful of the following:

This information is just to create more awareness. I have some good local contacts if you have further questions, just let me know.

This month’s update is short and not so sweet. The market activity is still very strong and has not changed…yet.

Big BREAKING MORTGAGE NEWS in the last few days is regarding the purchase of 2nd homes. A new Treasury Amendment now limits Fannie Mae on the acquisition of single-family mortgage loans secured by the second home and investment properties to only 7%. As a result, this could equate to as much as a half-percent higher rate on these loans. Click here for the full article.

No market is immune to these kinds of changes. If you’re wanting to purchase on the OBX, the time is now! Of course, that means we need more inventory. If you’re thinking of selling and want a complete analysis of what your home is worth, contact me today!

It’s no secret the real estate market on the Outer Banks is shifting. Even as we move into a seller’s market, keep in mind a majority of our home sales are secondary homes. This means more than 50% of our home buyers will spend up to 2 years searching for the right home. They can do that because they aren’t physically moving into the home.

It’s no secret the real estate market on the Outer Banks is shifting. Even as we move into a seller’s market, keep in mind a majority of our home sales are secondary homes. This means more than 50% of our home buyers will spend up to 2 years searching for the right home. They can do that because they aren’t physically moving into the home.

Being a discretionary purchase, they have the time to wait for the right house. That means even if you have the upper hand in terms of lower inventory and potentially rising prices, buyers still want what they want. Your home can still sit on the market for a prolonged period of time if it’s not set up to sell in today’s real estate market.

We’ve put together a checklist of readiness to ensure your home can hit the market and sell for the best price in the fastest time frame. Consider the following market statistics:

If closed sales for January and current Under Contract numbers are at record highs, we could easily see 2020 hit the 2,000 single-family homes sold mark. That means we barely have half the homes on the market right now that could potentially sell this year.

The following checklist is designed to get you the most for your home in the current market:

Let’s face it, the last time we had this kind of market shift in 2000, a home built in 1985 was only 15 years old. Today, that home is now 35 years old. In the extreme weather environment, we have on the OBX, a lot can happen in 35 years. If your home is more than 10 years old, you need a pre-listing home inspection. The number one cause for deals to fall apart is a home inspection revealing more than the eye can see. Buyers get nervous and walk. When that happens, the entire world knows your home sold, then un-sold, and everyone wants to know why. The items discovered will most likely become a material fact and have to be disclosed to future buyers. If an inspection is done beforehand, major items can be addressed and taken care of. End of story. There is no reason to list your home blindly and set yourself up to negotiate the “unknown” 2 to 3 weeks into a sale.

Even if a home inspection reveals no issues, sometimes systems will be at the end of their life expectancy. Buyers today do not want to walk into automatic maintenance without expecting a deep discount. If your 20-year roof is on year 18, it is wise to replace it. There’s no guarantee you can add that cost to the top of your asking price, but what it can do is sway a buyer towards your property versus another. The number one concern for buyers today is condition. Your home does not become more valuable because the systems work. However, it does immediately become more saleable.

This should be a no-brainer, yet all the time I show or preview homes that look like they’ve been abandoned. Everyone likes things that look nice. Take an honest look at your home’s exterior and interior. One of the easiest spaces to turn off a buyer is the carport and outside shower area. Buyers say all the time, you can tell how well the owners have cared for this home by how those areas look. Clean up the leaves, sand, junk that can accumulate. Power wash the gunk off the decks and siding. Get the interior a nice spring clean. First impressions don’t generally get a do-over.

What will buyers see as they approach your home, climb the stairs and enter the front door? Is it inviting? Is the door rotted or rusted? Does the key work easily? Are there spider webs or overgrown plants and weeds? This will set the tone for the entire showing. Sometimes buyers will change their minds about seeing a home altogether if the entry isn’t pleasant. Be mindful of the best way to enter your home. If your electronic keypad is on a door that isn’t the best entry, insist on giving your agent a key to the best entrance and have buyers go in that way. I recently went into preview a $750,000 home that was quite lovely. The entrance had imported tile, great artwork and felt very welcoming. The agent gave me a keycode that opened a door to an empty two-car, cold, garage. This is not the first impression you want.

No matter what time of year you list your home for sale, take a good look at the landscape of your yard, which is the main aspect of curb appeal. Having branches scraping the side of your car as you pull into the driveway is not a good look! Do what you can to clean it up for whatever is appropriate for the season.

Whether you live in the home or it’s your vacation home, have a professional eye look and give advice on how to stage it to sell. Most people need to see space, rather than stuff, in order to envision themselves in your home. Less is more when it comes to wall hangings and nick-knacks. Updating bedspreads and shower curtains is an easy way to give the home a fresh look. If the home is being sold furnished, some fresh, beachy furnishings can make all the difference.

With the new HGTV culture, buyers expect homes to be already updated. This type of preparation can take several months to do. These are the things you want to plan 6 months to a year before you list your home for sale. Depending on whether you live there or rent, everyone can also get a chance to enjoy the upgrades as well. Before spending any money, decide what your budget is and have an agent come over to advise the best use of that money. Some updates will prove a better return than others. We talk to hundreds of buyers a year, so we have a clear idea of what will get you the most for your money. Be prepared though, construction costs have doubled in the last 10 years. You’ll want to really follow a plan to stay on budget and get the most out of it.

With the growing popularity of VRBO and Air BnB type of rental arrangements, there are some real challenges when selling. Those types of reservations, when done solely through the property owner, are automatically not transferrable when selling. If a buyer is relying on the income of your home to make the purchase, you could run into some real issues at the closing table. Even if you are renting through a traditional property management company, there can be cancellation fees you incur if the new buyer doesn’t stick with your rental company. It’s becoming increasingly more important to employ the proper timing strategy to sell, depending on the source of your weekly guests. Talking to an agent ahead of listing about how the transfer works will help avoid any major stresses once the home is under contract.

Getting an offer on your home in an active market seems quite easy, and in most cases it is. What do you need an agent for then? Well, finding the buyer is just the first of dozens of steps in getting your home sold.

The question becomes, do you want to ensure you are getting maximum VALUE as well as maximum CONVENIENCE when selling? It’s actually a pretty pain staking process to go through the entire 45 to 60 day process and requires many, many hours of time.

Many sellers think they can get an offer and then “let the attorney handle it”. Yes, your attorney can manage the CLOSING. That simply entails preparing your deed and handling the transfer of money AT THE END OF THE TRANSACTION.

Bottom line, we are experiencing an extreme number of homes selling per month. All requiring an attorney to manage the closing. The attorney is not available to answer calls throughout the day to deal with the day to day situations that come up during your closing process. In addition to that, if they were available, they would be charging you per hour for that time. Most attorneys charge around $200/hour. On average an agent will spend 30 to 40 hours working on your transaction.

Even if you offer a commission to a Buyer’s Agent and think they can assist with these tasks, that’s true. However, the Buyer’s Agent works for the buyer. You are now essentially paying the buyer’s agent to work AGAINST you, without your own representation.

In the end, the best way to maximize VALUE and CONVENIENCE is to have a professional agent manage the ever challenging task of getting your home sale to a successful closing.

Supply and demand. That’s the basic economic principle driving markets for decades. Here we are! Finally experiencing some movement in the northern beaches market, after the slowest recovery ever from the 2008 market crash.

Sellers – if you want to cash in – now is the perfect time! Condition is still important to maximize profits, so contact me before any repair work so we can make the most of your investment.

Buyers – be pre-qualified, ready to sign an offer, prepare to offer virtually, and be prepared to offer over asking price in many cases. You need someone scanning the new listings daily. Now is not the time to go unrepresented. Let me know if you’re looking!

Corolla

57 Active listings 108 Under Contract

Duck

23 Active listings 22 Under Contract

Southern Shores

15 Active listings 19 Under Contract

Kitty Hawk

6 Active listings 17 Under Contract

Kill Devil Hills

24 Active listings 65 Under Contract

Nags Head

38 Active listings 38 Under Contract

Now you can see what we are working with. Contact me if you have any questions about our current market.

I do predict it will last this way through the year.

How does inventory truly affect the real estate market? In a big way!!

Take a look at these two charts outlining the absorption rate for each location. FYI – absorption rate is a breakdown of how many months it would take to sell out the current inventory based on number of homes selling each month. This is important because it is the primary factor in determining if there is a rising, stable, stagnant or declining market (see graph below for more explanation).

As you can see, every location has experienced a decline in the amount of available inventory, some a very dramatic and sharp decline. This is the precursor to the next step, rising prices. It’s important we see prices rise gradually, over time, or we will experience another cycle like we saw in 2005. I don’t think anyone wants to do that over again.

Bottom line, if you are on the fence about buying or selling, jump! The market is ready for you. To strategize to your specific needs, please contact me.

4826 N Croatan Hwy

Kitty Hawk, NC 27949

Work: (252) 261-3815 Cell: (252) 619-5225

You will receive the most up to date Outer Banks news once a month like information on flood insurance, market stats and updates, bridge news, local happenings and more!