Beach Realty and Construction’s Agent of the year for 2022

Congratulations to Beach Realty and Construction’s Agent of the year for 2022, Ilona Matteson! This is Ilona’s third year in a row earning the title of Agent of the Year! In the year 2012 Ilona first achieved this award and has gone on to earn the title 5 more times! We are proud to have Ilona as a leader, trainer, and valued agent on our team.

Ilona Matteson brings a wealth of experience and knowledge to the sales team at Beach Realty & Construction. As a former sales manager for Beach Realty and a former coach for the nationally acclaimed Mike Ferry Organization, Ilona knows the real estate business inside and out. In 2004, she was selected for the annual 30 Under 30 feature for Realtor Magazine and was also a licensed instructor employed by the North Carolina Academy of Real Estate. Ilona has a thorough understanding of market conditions and works diligently for her clients.

Be sure to call Ilona Matteson for all your Real Estate Needs!

What an interesting few years in the real estate world, and the world in general! I got to spend a good bit of time with my niece and nephew over the last 18 months and do a little bit of traveling. After 26 years in the business, I was so grateful and fortunate to have the opportunity to still assist some new and past clients while enjoying that precious time with family!

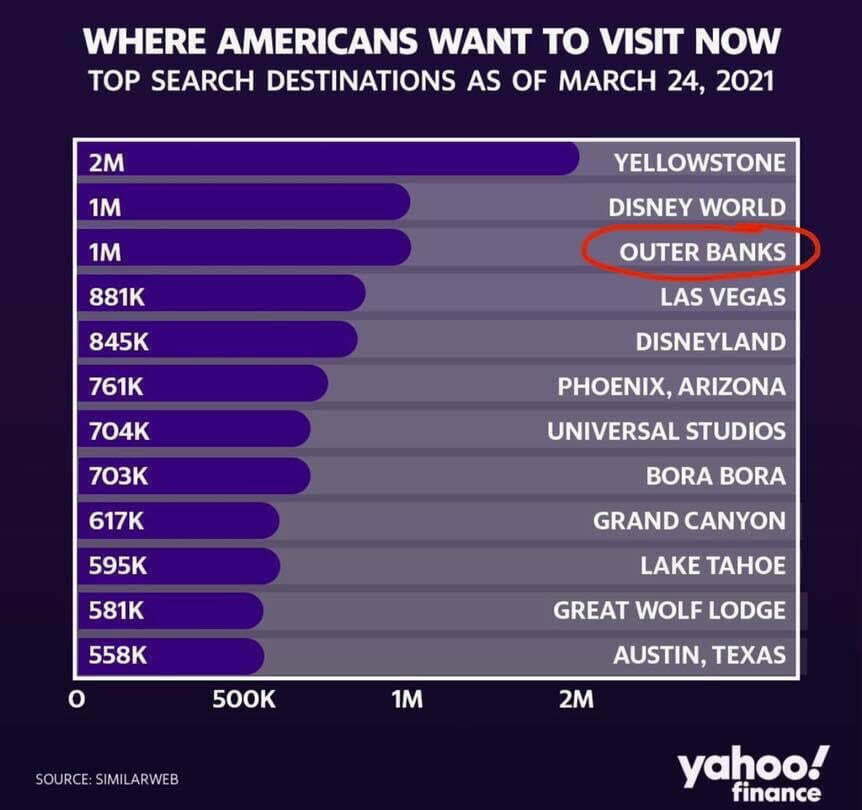

What an interesting few years in the real estate world, and the world in general! I got to spend a good bit of time with my niece and nephew over the last 18 months and do a little bit of traveling. After 26 years in the business, I was so grateful and fortunate to have the opportunity to still assist some new and past clients while enjoying that precious time with family! Let’s talk about INVENTORY. Most people don’t realize that inventory level is the key determining factor for real estate prices. If I had a dollar for every time someone asked about the bridge in relationship to values, I would have a whole lot of dollars! And yes, there are a lot of factors that play into value.

Let’s talk about INVENTORY. Most people don’t realize that inventory level is the key determining factor for real estate prices. If I had a dollar for every time someone asked about the bridge in relationship to values, I would have a whole lot of dollars! And yes, there are a lot of factors that play into value.