We are fully into our summer season here on the Outer Banks. As expected, the summer months typically bring in a decline in sales as well as inventory. While we still have a fairly active market over the summer, some property owners just elect to wait out the season and sell in the fall.

Here are the most important market points:

- Sales for the year so far are down 5% over last year

- Inventory is also down 5% from last year

- Land sales are down 11% from last year

- Land inventory is down 8% from last year

- Number of homes going under contract is also in a steady decline since April

- This is largely due to the rise in interest rates

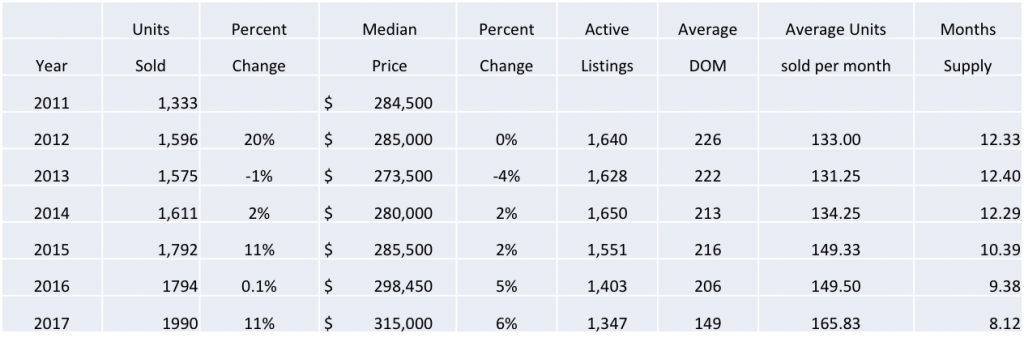

Taking a look at the chart below, you’ll see the cycles we’ve experienced in market activity. It’s not uncommon after a year with double digit increases to have a flat year following it. What is most exciting is the inventory level change since 2012.

The other notable difference in our market is the way buyers are buying. We are seeing much more emphasis being put on price and condition rather than location and rental income. I wrote about this a few months back, click here to read that article again.

As always, if you have any questions about buying or selling please contact me for an analysis.