Duck Jazz Festival

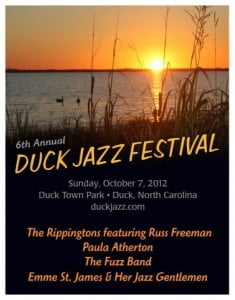

Everybody is so excited for the 6th Annual Duck Jazz Festival that will be held at Duck Town Park on October 7th! Beach Realty & Construction/Kitty Hawk Rentals is proud to be an alto sponsor for this event. The gates open at 10:00 with the event scheduled to begin at 11:00. The best part is this is a free, all-day community event.

Everybody is so excited for the 6th Annual Duck Jazz Festival that will be held at Duck Town Park on October 7th! Beach Realty & Construction/Kitty Hawk Rentals is proud to be an alto sponsor for this event. The gates open at 10:00 with the event scheduled to begin at 11:00. The best part is this is a free, all-day community event.

Here is the lineup for the day:

11:00 a.m. – Emme St. James and Her Jazz Gentlemen

12:15 p.m. – The Fuzz Band

2:15 p.m. – Paula Atherton

4:15 p.m. – The Rippingtons featuring Russ Freeman

Food and beverages will be available for sale. Make sure you save some time to explore the boardwalk with the fantastic view plus all the great stores and restaurants. You don’t want to miss out on this family fun day!

Get your Pirate on!

Pirates were one of the realities that merchants along the Outer Banks had to deal with throughout the late 1600’s and early 1700s. Pirates attacked and raided Spanish and British ships carrying gold, silver and other riches. They used the outer Banks as an escape and to store their loot. Blackbeard also known as Edward Teach lived in Ocracoke until November 22, 1718 when the British Royal Navy cornered him. Blackbeard went down fighting instead of surrendering.

In the Outer Banks we have had several famous pirates such as Anne Bonny, Calico and Pamlico Jack, Mary Read, and Stede Bonnet.

The Outer Banks Pirate Festival will kick-off on Thursday, September 13 and carry on with festivities on Outer Banks until ending on Saturday, September 15. Discover Pirate history and everything Pirate from a Scallywag School for Young Scoundrels, how to use pirate weapons, storytelling, and pictures and more with pirates, pirates everywhere!

The event kicks on Thursday with a treasure hunt that begins at Kitty Hawk Kites and continues with a search through the stores of Jockey’s Ridge.

Get ready to get your Pirate on… Argh, Mateys!

For more information go to: Outer Banks Pirate Festival

Best Buys on the Outer Banks for the week of September 4th, 2012

Contact Me About Any of These Properties!

Great Sporting Events in the Outer Banks

Grab a friend or a family member and head out to have a fun time!

Wave conditions in the area are likely to provide some of the best action found in the US.

Best Buys on the Outer Banks for the week of August 27, 2012!

Contact Me About Any of These Properties!

Best Buys on the Outer Banks for the week of August 20th!

Contact Me About Any of These Properties!

Best Buys on the Outer Banks for the week of August 13th, 2012

Contact Me About Any of These Properties!

19 Athletes from North Carolina are Competing in the 2012 Summper Olympics!!

The Olympics

The Olympics starts this Friday! Love the summer Olympics and the opening ceremony. Here is the link – http://www.london2012.com/ if you want to keep up to date with all that is going on with the Olympics for the next few weeks.

I tried to discover if there were any competing athletes with ties to the Outer Banks and was not successful. I did find that out of 600 competing American athletes we do have 19 athletes representing North Carolina. Most of these athletes we may or may not see, but it will be fun to cheer for someone from our state.

Ricky Berens – Is a swimmer that competed in Beijing and was part of the winning 800 meter relay team. He swam the third leg of the 800m freestyle relay final at the Water Cube, where the U.S. won by more than five seconds over second-place Russia and third-place Australia. The time of 6 minutes, 58.56 seconds also set a world record.

Marko Blazevski – Is also a swimmer and will be competing in the 400-meter individual medley. He is a rising Junior at Wingate University in Wingate, NC.

Cullen Jones – He won a gold medal in Beijing for a 4×100 relay. He will be swimming in the same relay but will also race in the 50 and 100 meter freestyle.

Nick McCrory – is one of the best divers in America. He grew up in Chapel Hill, NC and went to Duke University. He is 20 and this is the first time he has made the Olympic team, he will be competing in the 10 meter platform individual even and synchronized diving.

Shalane Flanagan – is long-distance runner that currently holds the American record times in the 3000 m, 5000 m, and 10,000 m. She is also the Bronze Medalist from Beijing in the 3k, 5k and the 10k. Shalane is a graduate of University of North Carolina in Chapel Hill. She will be competing in the marathon.

Hunter Kemper – will be competing in the triathlon. He competed in 2000, 2004 and 2008 as Triathlete in the Olympics. He was born in Charlotte and attended Wake Forest University. He is the only American male that is ranked as the number one triathlete in the world and will be the first triathlete featured on a Wheaties Box.

Other Notable Athletes with North Carolina Ties are:

Dremiel Byers – Wrestling

Casey Eichfeld – Canoe/Kayak

Eric Hurd – Canoe/Kayak

Caroline Queen – Canoe/Kayak

Nick Thoman – Swimming

Rachel Dawson – Field Hockey

Katelyn Falgowski – Field Hockey

Tobin Heath – Soccer

Heather O’Reilly – Soccer

Caroline Lind – Rowing

John Isner – Tennis

Charlie Houchin – Swimming

Chris Paul – Basketball Lauren Perdue – Track & Field

GO USA!!

Outer Banks Update July 24, 2012

Sales activity continues to be higher than last year. June finished with a 19% increase of sold properties over June 2011. Properties going under contract are still on the rise as well. Typically the summer months see a bit of a slow-down in activity, which we have, yet still maintained the increase. I suspect the Fall Market will be very strong indeed.

Sales activity continues to be higher than last year. June finished with a 19% increase of sold properties over June 2011. Properties going under contract are still on the rise as well. Typically the summer months see a bit of a slow-down in activity, which we have, yet still maintained the increase. I suspect the Fall Market will be very strong indeed.

Pricing seems to be stabilizing. Some towns are still declining while others are holding steady. For specific information on your location send me an email and I’ll get you a report.

The study on erosion in Duck is underway and the results of Phase I of this study will be presented to the public on August 15th at 1 pm. For more information click here.

There is no new news on the Mid-Currituck Bridge. We’re not expecting any updates until the end of this quarter.

As you can tell, I have a brand new website launched! This site is very user friendly and should provide you with all the searching tools needed to find out what’s for sale on the Outer Banks. I encourage you to check it out and take a look at my blog. If you haven’t done so already – follow me on Facebook, Twitter & / or Linkedin!

Doing a short sale in North Carolina is about to change. The NC Association of Realtors recently made several revisions to the Short Sale Addendum. For a quick video on the most impactful changes click here.

That’s all for this month. As always if I can answer your real estate questions please contact me!