What’s interesting about this time of year, is that we can really see the major trends going on in

the marketplace for the calendar year. I’m highlighting 3 specific points for this analysis.

Inventory

Inventory levels on the Outer Banks, specifically northern beaches, have been particularly

challenging for our market. The fact is, in Duck and Corolla, there are little to no primary sales

taking place. That is, no one is physically moving into or out of that area. Those kinds of sales

are crucial to market health because those people “HAVE” to buy and sell. The truth is, 100% of

the sales that take place in those areas are discretionary.

Nearly every seller we meet says the same thing…”We don’t have to sell.” Which is very true.

You don’t have to sell because you’re not making a physical move, nor are you in financial

distress. It’s important to recognize that 99.9% of sellers we work with, don’t HAVE to sell.

There’s a common misconception that pricing your home to sell in today’s market is the same

as discounting it to force it to sell. That’s simply not true. Today’s market in Duck and Corolla

simply has an oversupply of inventory and an under-supply of buyers. That’s the bottom line.

It’s a resort market where all sales are discretionary. Period. I encourage you to ask the

following question. Just because I don’t have to sell, does that mean keeping the home is in

the best financial interests of myself/family/long term plan? That’s what it really boils down

to. I know it’s difficult to swallow the prices today’s market requires, but consider the whole

picture before making a final decision.

The price in these kinds of markets are 100% dependent on the principle of supply and demand, because buyers don’t HAVE to buy until they find the home that ticks all the boxes for them.

Consider this in Corolla:

– Corolla has 294 homes currently for sale.

– 189 homes have sold so far this year; that’s 19 sales a month

– 19 buyers will buy each month and they have 294 to choose from

– 26 Oceanfront homes sold this year in Corolla

– That’s 2.6 buyers a month

– There are currently 53 oceanfront homes for sale in Corolla

Consider this in Duck:

– Duck has 128 homes currently for sale

– 104 homes have sold so far this year; that’s 10 sales a month

– 10 buyers will buy each month and they have 128 to choose from

– From $400,000 to $800,000 there are 52 homes currently for sale

– 47 have sold this year in that range; 4.7 buyers a month

– 4.7 buyers will buy each month and they have 52 to choose from

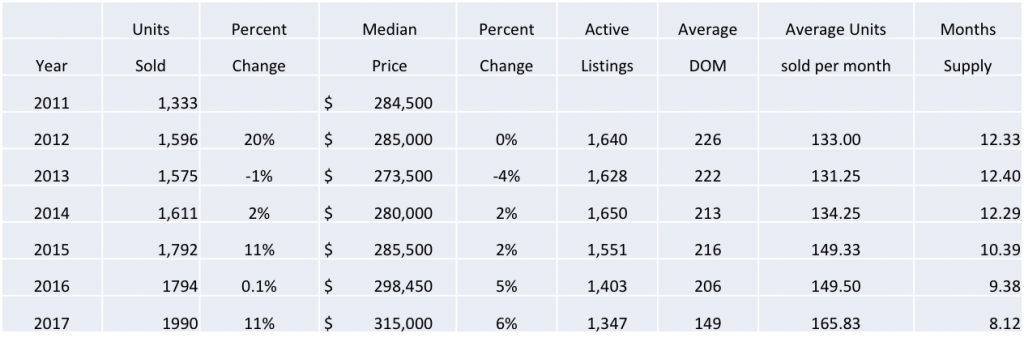

This is why inventory is the biggest indicator of value in the market right now. We have seen

major improvement in inventory levels over the last few years. This year, we are seeing that

inventory move back up, even just slightly. What does this mean? It means that appreciation is

not happening any time soon, and, that depreciation is still a very real possibility. I don’t report

this to be negative, just to be realistic. Waiting out the market is not a short term endeavor.

Bottom line…inventory is the single biggest challenge in the northern Outer Banks market.

Until that changes, your price won’t either.

Days on Market

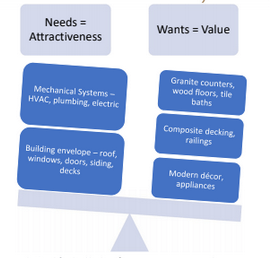

The shining point of our market has been the amount of time it takes to get a home that is

priced right, sold. Priced right mostly means priced for its condition. Condition has become the

single greatest factor in a buyer’s decision. They will bypass location for an updated home

almost every time. For more information on the impacts of condition, click here.

The days on market number has gone DOWN again this year by another 20%. This is the third

year in a row this number has dropped by 20% or more.

What does this mean?

– Buyers are watching and waiting for the best value. They study the market for 18

months or more before making a decision to buy. When they see a home that is a good

value, they act quickly and with near full price.

– If your home is on the market for more than 118 days, buyers don’t consider it to be a

good value.

The real estate market is fluid. Pricing your home on one day based on the competition is only

as good as that competition stays the same. As homes sell and adjust their price, you have to

flow with it. In this kind of market, you can either lead with an aggressive price and sell, or,

follow the price others set for you as they sell. Why leave your pricing up to someone else’s

motivation?

Total Sales

Not only did the number of homes going under contract drop by 19% for October, the total

number of sales year over year is down by 10%. Blame the hurricane, the election, whatever

you like. It doesn’t change the facts.

Here’s the deal…interest rates are up, inventory is slightly up, sales are down by double digits.

I’m not telling you this to create panic. My job is to sell homes regardless of the market

conditions, which I have done for over 22 years. My job is also to keep you informed on the

trends, as they are happening. We don’t have a crystal ball, so statistics are the next best thing.