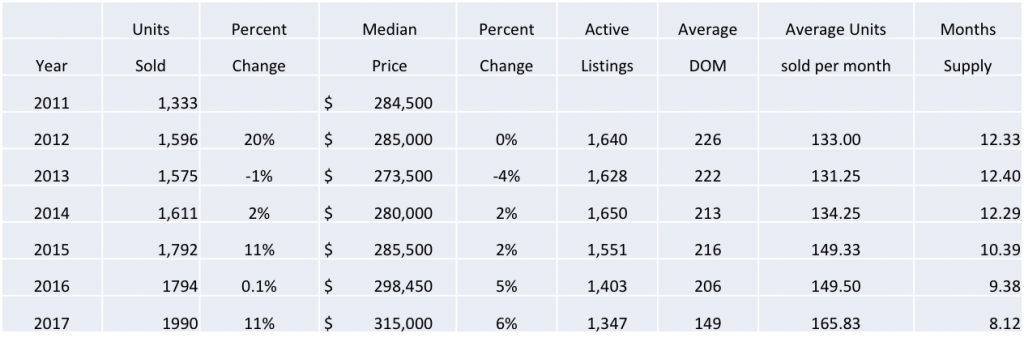

Let’s take a quick look at the highlights of the market activity so far this year.

- First Quarter residential sales are up by 4% from last year

- Actual March sales are down from last March by 9%

- Under contract homes are up 9% from last March

- Inventory is on the rise. Up 9% from last March and the highest number of homes for

sale since June 2017 - Land sales are down 33% and average price went from $100,000 down 50% to $50,000

- Distressed sales continue to fall with only 18 active listings in the entire area

- New building permits last year total were 49, we are already at 33 for this calendar year

- Overall rental companies are reporting a decline in the number of homes booked this

year over last year

Summary: We had a slow start to the year for rentals because of the government shutdown.

Most of our visitors come from the VA/MD/DC area and with no income in January, fewer

vacations were booked. It does seem to be picking up some.

As predicted earlier this year, I am not surprised to see this activity report. We have solid

activity, but are not expecting a banner year, which is normal after coming off a few hot and heavy

years of activity. Nothing to worry about long term, just keep watching.If you feel like this might be the year to sell, but just aren’t sure, click here to read “What to do if you don’t HAVE to sell your home.”