Reprinted with permission from the Outer Banks Association of Realtors.

Settlement Reached on Dwelling Rates

The NC Rate Bureau and the NC Department of Insurance (NCDOI) reached a settlement agreement this week on a Dwelling Rate Filing that was submitted in February of this year. The Rate Bureau was proposing an overall statewide average increase in dwelling policy rate of 18.9%.

NC Insurance Commissioner Mike Causey was able to negotiate a much lower average overall statewide increase in dwelling policy rates to 4.8%. The settlement also realigns some territories to be consistent with the boundary lines on the homeowners insurance rate map.

Dwelling policies differ from homeowner policies. Dwelling policies typically cover non owner- occupied second homes, vacation rental homes or year-round rental homes and do not include liability coverage.

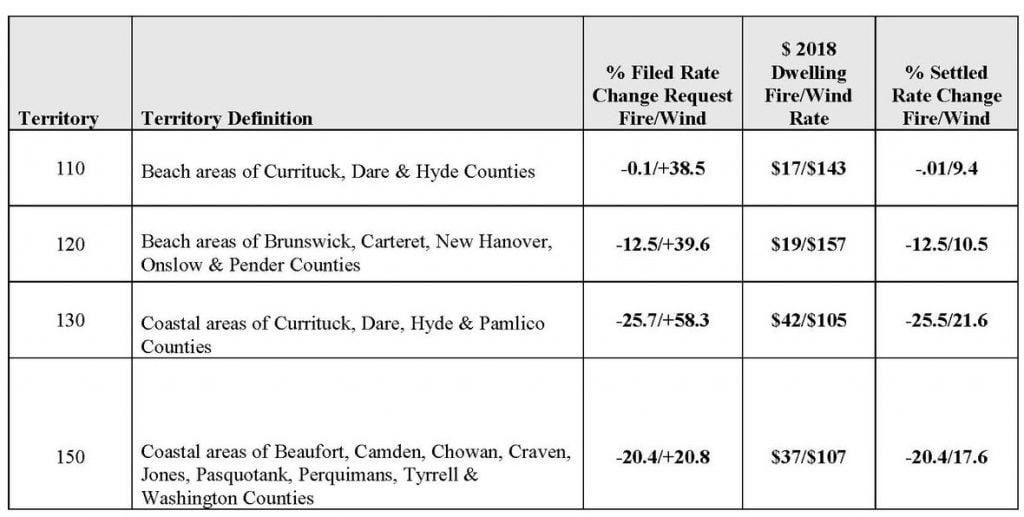

By reaching an agreement with the NC Rate Bureau, Insurance Commissioner Mike Causey has avoided a public hearing on the filing which was scheduled to begin August 20th. Below is a chart of the proposed rate changes by percentage, the current rate and the approved percentage changes.

In the eastern NC coastal area, the fire coverage rate is going down but the wind and hail (extended coverage) rate is going up. Fortunately, the wind rate is not going up to the extent that was proposed. Wind rates are three to eight times higher than fire rates so a double-digit increase in wind rate is going to have significant impact on policyholders. The Fire and Wind portion of the rate is based on $15,000 Coverage, Base Class is Form DP-001. The new rates become effective February 1, 2019 and also impact those with dwelling policy coverage under the NCIUA (Coastal Property Insurance Pool). Changes to contents coverage are also included in the settlement agreement.

The press release and associated maps and charts from NCDOI can be found here.