Being a Listing Specialist requires a certain level of understanding of the local market statistics. Taking an in depth look at the trends causing homes to sell is critical to knowing the big picture.

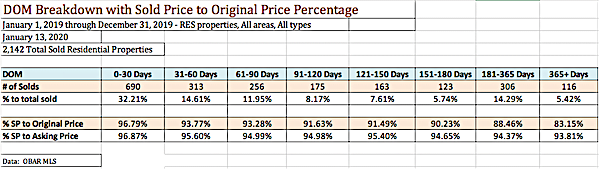

In the chart presented below, I’ve broken down the relationship between the following:

- The number of days a home took to sell – which means receive a ratified contract

- The percentage of final sales price to the original listing price

- The percentage of final sales price to the listing price at the time of sale

Each of these figures on its own tells a lot, and when combined into a complete picture, tells us many more things. Here are the basic takeaways from this particular data:

- Out of 2,142 total sales, 32% sold in 30 days or less

- The homes selling in the fastest amount of time receive the highest percentage of asking price as the final selling price – 97%

- Properties sold in 31 to 60 days make up 15% of all sold

- Yet, it seems even these quick sales a small adjustment in price was needed

- 47% of all properties sold last year did so in 60 days or less

With nearly half of all sales taking place in 2 months time, it presents a clear picture that buyers are ready and willing to take action when they find the right property. Selling at 97% and 95 of asking price, this tells us that price is the main attraction to their fast action. They see value and move quickly.

What does overpricing your home actually cost? Notice the bottom 20% of properties sold, took 6 months to over 1 year to sell.

- Final sales price was 12% to 17% lower than the original asking price

- Continue paying monthly for a home they no longer want to own

- Any repair issues that may have popped up

- Additional repairs requested from buyer during the sale from inspections

- Missed opportunity cost from waiting it out

Overall what we can take away from this kind of detailed analysis is, pricing your home to fit the current market conditions will actually net you more in the end. This is why as a highly skilled agent, I’ve learned to always ask you the question – Is it more important to get your price, or to get the home sold?

I’ve studied the data and know, you’ll net more by approaching the market with a value-based price than by “leaving room to negotiate.” That is an outdated strategy that just doesn’t work anymore.