February OBX Market Update

WHY DO YOU NEED A PROFESSIONAL REAL ESTATE AGENT, EVEN IN THIS MARKET?

Getting an offer on your home in an active market seems quite easy, and in most cases it is. What do you need an agent for then? Well, finding the buyer is just the first of dozens of steps in getting your home sold.

The question becomes, do you want to ensure you are getting maximum VALUE as well as maximum CONVENIENCE when selling? It’s actually a pretty pain staking process to go through the entire 45 to 60 day process and requires many, many hours of time.

Many sellers think they can get an offer and then “let the attorney handle it”. Yes, your attorney can manage the CLOSING. That simply entails preparing your deed and handling the transfer of money AT THE END OF THE TRANSACTION.

Here’s what it doesn’t include:

- Pre-Qualifying the buyer/agent/offer to make sure it’s a solid deal

- Negotiating for the highest dollar

- Choosing the best offer, in the case of multiple offers (it’s not always about the highest price)

- Negotiating the home inspection, including finding contractors to give estimates, and meeting them at the home

- Pest Inspection, Septic Inspection, Pool/Hot Tub, HVAC – knowing vendors and meeting them at the home

- Prepping the appraiser or answering comparable questions – attorneys don’t have access to MLS, nor have been in the latest homes sold

- Staying on top of the buyer’s loan process

- Knowing which lenders and other vendors perform on time

- Working with the rental company to transition buyer

- Handling the dozens of calls from buyer/buyer’s agent throughout the process

Bottom line, we are experiencing an extreme number of homes selling per month. All requiring an attorney to manage the closing. The attorney is not available to answer calls throughout the day to deal with the day to day situations that come up during your closing process. In addition to that, if they were available, they would be charging you per hour for that time. Most attorneys charge around $200/hour. On average an agent will spend 30 to 40 hours working on your transaction.

Even if you offer a commission to a Buyer’s Agent and think they can assist with these tasks, that’s true. However, the Buyer’s Agent works for the buyer. You are now essentially paying the buyer’s agent to work AGAINST you, without your own representation.

In the end, the best way to maximize VALUE and CONVENIENCE is to have a professional agent manage the ever challenging task of getting your home sale to a successful closing.

January 2021 Market Update

Supply and demand. That’s the basic economic principle driving markets for decades. Here we are! Finally experiencing some movement in the northern beaches market, after the slowest recovery ever from the 2008 market crash.

Sellers – if you want to cash in – now is the perfect time! Condition is still important to maximize profits, so contact me before any repair work so we can make the most of your investment.

Buyers – be pre-qualified, ready to sign an offer, prepare to offer virtually, and be prepared to offer over asking price in many cases. You need someone scanning the new listings daily. Now is not the time to go unrepresented. Let me know if you’re looking!

Corolla

57 Active listings 108 Under Contract

Duck

23 Active listings 22 Under Contract

Southern Shores

15 Active listings 19 Under Contract

Kitty Hawk

6 Active listings 17 Under Contract

Kill Devil Hills

24 Active listings 65 Under Contract

Nags Head

38 Active listings 38 Under Contract

Now you can see what we are working with. Contact me if you have any questions about our current market.

I do predict it will last this way through the year.

AGENT OF THE YEAR 2020 – ILONA MATTESON

Ilona Matteson, associate broker for Beach Realty & Construction / Kitty Hawk Rentals was named the company’s agent of the year for 2020. Ilona also earned agent of the year honors in 2015, 2016 & 2012. Ilona was licensed in the late 1990’s and became sales manager for Beach Realty in 2002. In 2006, she moved to Richmond, VA and was affiliated with a national coaching company where she excelled as a one-on-one coach for real estate professionals. The allure of the Outer Banks brought her back to the beach and she resumed her career in real estate sales. She quickly became a top producer and attributes her success to hard work, discipline and in-depth knowledge of the local market. Along with her successful career in real estate sales, Ilona also offers training and coaching to the sales team at Beach Realty & Construction.

Ilona Matteson, associate broker for Beach Realty & Construction / Kitty Hawk Rentals was named the company’s agent of the year for 2020. Ilona also earned agent of the year honors in 2015, 2016 & 2012. Ilona was licensed in the late 1990’s and became sales manager for Beach Realty in 2002. In 2006, she moved to Richmond, VA and was affiliated with a national coaching company where she excelled as a one-on-one coach for real estate professionals. The allure of the Outer Banks brought her back to the beach and she resumed her career in real estate sales. She quickly became a top producer and attributes her success to hard work, discipline and in-depth knowledge of the local market. Along with her successful career in real estate sales, Ilona also offers training and coaching to the sales team at Beach Realty & Construction.

You can contact Ilona at [email protected] , 252-619-5225 or visit her agent detail page.

August 2020 OBX Market Report

How does inventory truly affect the real estate market? In a big way!!

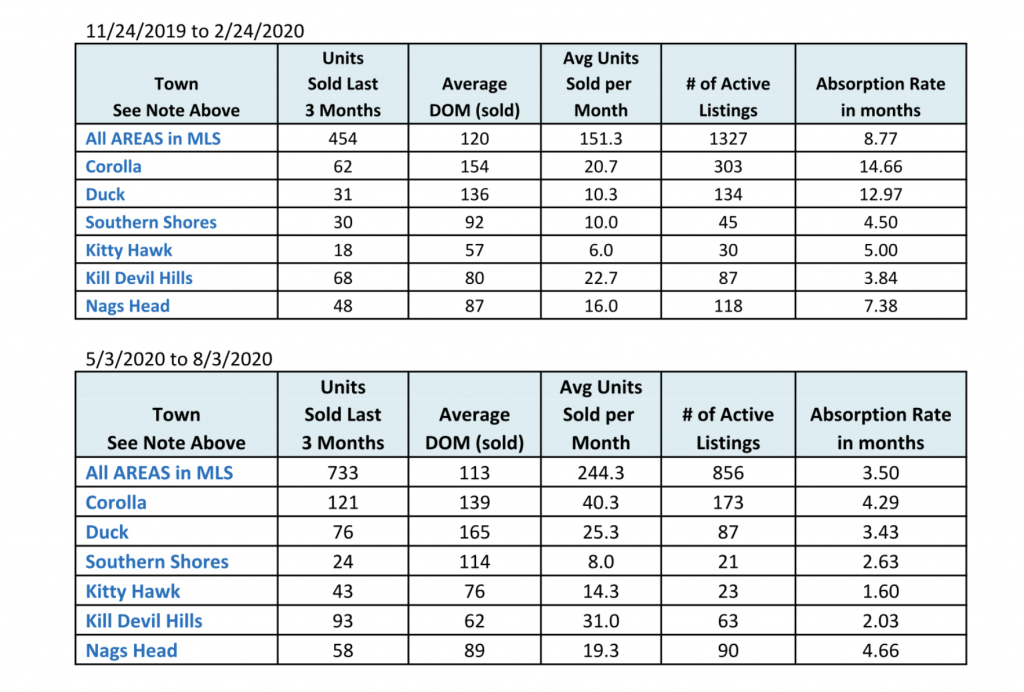

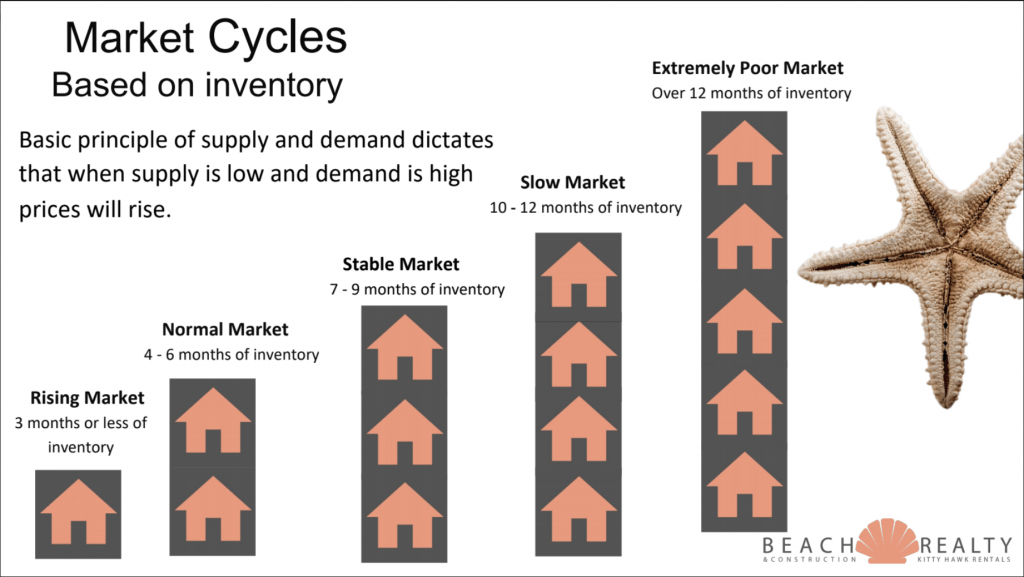

Take a look at these two charts outlining the absorption rate for each location. FYI – absorption rate is a breakdown of how many months it would take to sell out the current inventory based on number of homes selling each month. This is important because it is the primary factor in determining if there is a rising, stable, stagnant or declining market (see graph below for more explanation).

As you can see, every location has experienced a decline in the amount of available inventory, some a very dramatic and sharp decline. This is the precursor to the next step, rising prices. It’s important we see prices rise gradually, over time, or we will experience another cycle like we saw in 2005. I don’t think anyone wants to do that over again.

Bottom line, if you are on the fence about buying or selling, jump! The market is ready for you. To strategize to your specific needs, please contact me.

July 2020 OBX Market Report

A lot of people have been asking me why the market has suddenly taken a turn. Fortunately this time, it’s a really good turn! The answer is quite simple if we take a look at the history of these real estate cycles.

I’ve been saying for over a decade now that these cycles, in recorded history, generally take about 20 years each turn. This is proven true over and over for the last 80 plus years. So, if we take a look at the last few cycle timelines, it just makes sense for this to be happening right now.

1985/6 – Real estate was booming – then – stock market issues, S&L crisis began

1988/9 – Things really fell apart – prices were at an all time high.

1998 – Prices started to return to the pre-boom spot (I specifically remember an oceanfront lot in Sanderling that we couldn’t give away for $250,000)

2000 – Activity went through the roof – the 10% ratio was introduced – property was selling fast, but no discernible increase in pricing, as the recovery was still in place.

2003 – 2005 – All hell broke loose. Prices soared, inventory was low, multiple offers on almost everything. We all remember those years.

2008/2009 – Once again, 20 years later another mortgage crisis and the whole thing fell apart.

2010 – 2019 – Very volatile times, especially for the northern beaches.

2020 – Once again, 20 years later we have another BOOM in activity, some areas are seeing a little boost in price, but overall no real trackable difference. It’s coming though!

All that being said, if you are thinking about buying – rates and prices are still quite reasonable. Income is high. I wouldn’t wait.

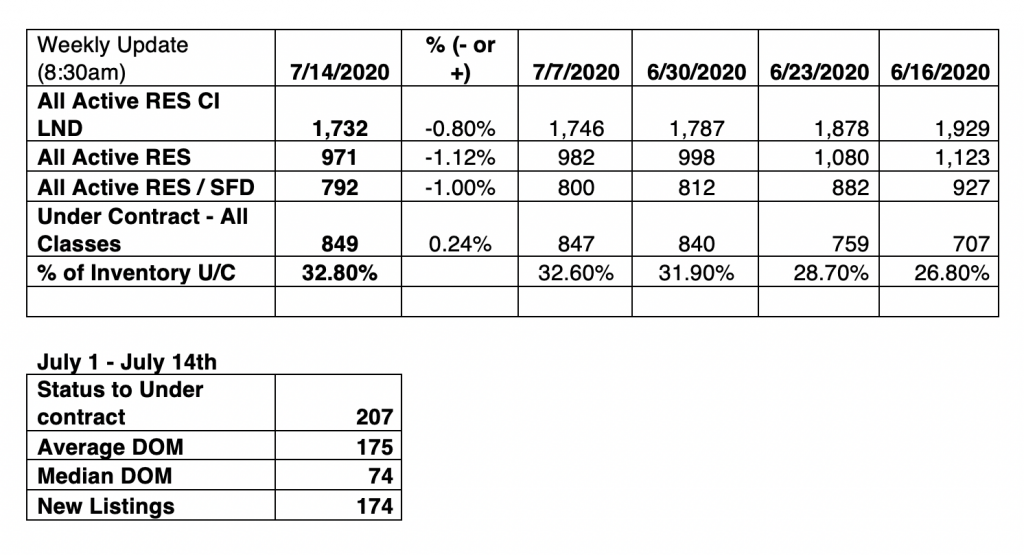

If you have been wanting to sell, get this…as of this week there are 850 properties under contract and only 792 single family homes active for sale. This is what anyone watching would call the “tipping point”.

I have seen in the last couple of weeks, multiple homes that have been for sale for YEARS, finally going under contract. Pay attention friends, it’s about to be another wild ride!

Here are some weekly stats to consider: (I’ve always said who needs a crystal ball when you track the statistics. This tells us everything we need to know.)

A new strategy is now needed to meet your real estate goals. If you would like to discuss the best strategy for you, please contact me right away!

Checklist For Readiness

It’s no secret the real estate market on the Outer Banks is starting to shift. Even as we move into a seller’s market, keep in mind a majority of our home sales are secondary homes. This means more than 50% of our home buyers will spend up to 2 years searching for the right home. They can do that because they aren’t physically moving into the home.

Being a discretionary purchase, they have the time to wait for the right house. That means even if you have the upper hand in terms of lower inventory and potentially rising prices, buyers still want what they want. Your home can still sit on the market for a prolonged period of time if it’s not set up to sell in today’s real estate market.

We’ve put together a checklist of readiness to ensure your home can hit the market and sell for the best price in the fastest time frame. Consider the following market statistics:

- In 2019 there were 1,842 single family homes sold

- Currently there are only 1,079 single family homes listed for sale

- Almost 60% (58%) of all properties sell in the first 90 days

- Median days on market is 69

- They are selling within 4% to 5% of asking price

If closed sales for January and current Under Contract numbers are at record highs, we could easily see 2020 hit the 2,000 single family homes sold mark. That means we barely have half the homes on the market right now that could potentially sell this year.

The following checklist is designed to get you the most for your home in the current market.

1. Have a Home Inspection

Let’s face it, the last time we had this kind of market shift in 2000, a home built in 1985 was only 15 years old. Today, that home is now 35 years old. In the extreme weather environment we have on the OBX, a lot can happen in 35 years. If your home is more than 10 years old, you need a pre-listing home inspection. The number one cause for deals to fall apart is a home inspection revealing more than the eye can see. Buyers get nervous and walk. When that happens, the entire world knows your home sold, then un-sold, and everyone wants to know why. The items discovered will most likely become a material fact and have to be disclosed to future buyers. If an inspection is done beforehand, major items can be addressed and taken care of. End of story. There is no reason to list your home blindly and set yourself up to negotiate the “unknown” 2 to 3 weeks into a sale.

2. Maintenance items

Even if a home inspection reveals no issues, sometimes systems will be at the end of. their life expectancy. Buyers today do not want to walk into automatic maintenance without expecting a deep discount. If your 20 year roof is on year 18, it is wise to replace it. There’s no guarantee you can add that cost to the top of your asking price, but what it can do is sway a buyer towards your property versus another. The number one concern for buyers today is condition. Your home does not become more valuable because the systems work. However, it does immediately become more saleable.

3. Powerwash/Clean

This should be a no-brainer, yet all the time I show or preview homes that look like they’ve been abandoned. Everyone likes things that look nice. Take an honest look at your home’s exterior and interior. One of the easiest spaces to turn off a buyer is the carport and outside shower area. Buyers say all the time, you can tell how well the owners have cared for this home by how those areas look. Clean up the leaves, sand, junk that can accumulate. Power wash the gunk off the decks and siding. Get the interior a nice spring clean. First impressions don’t generally get a do-over.

4. Prepare the entry way

What will buyers see as they approach your home, climb the stairs and enter the front door? Is it inviting? Is the door rotted or rusted. Does the key work easily? Are there spider webs or over grown plants and weeds? This will set the tone for the entire showing. Sometimes buyers will change their mind about seeing a home all together if the entry isn’t pleasant. Be mindful of the best way to enter your home. If your electronic keypad is on a door that isn’t the best entry, insist on giving your agent a key to the best entrance and have buyers go in that way. I recently went into preview a $750,000 home that was quite lovely. The entrance had imported tile, great artwork and felt very welcoming. The agent gave me a keycode that opened a door to an empty two car, cold, garage. This is not the first impression you want.

5. Yardwork

No matter what time of year you list your home for sale, take a good look at the landscape of your yard, which is the main aspect of curb appeal. Having branches scraping the side of your car as you pull into the driveway is not a good look! Do what you can to clean it up for whatever is appropriate for the season.

6. Declutter or staging

Whether you live in the home or it’s your vacation home, have a professional eye look and give advice on how to stage it to sell. Most people need to see space, rather than. stuff, in order to envision themselves in your home. Less is more when it comes to wall hangings and nick-knacks. Updating bedspreads and shower curtains is an easy way to give the home a fresh look. If the home is being sold furnished, some fresh, beachy furnishings can make all the difference.

7. Upgrades

With the new HGTV culture, buyers expect homes to be already updated. This type of preparation can take several months to do. These are the things you want to plan 6 months to a year before you list your home for sale. Depending on whether you live there or rent, everyone can also get a chance to enjoy the upgrades as well. Before spending any money, decide what your budget is and have an agent come over to advise the best use of that money. Some updates will prove a better return than others. We talk to hundreds of buyers a year, so we have a clear idea of what will get you the most for your money. Be prepared though, construction costs have doubled in the last 10 years. You’ll want to really follow a plan to stay on budget and get the most out of it.

8. Property Management Details

With the growing popularity of VRBO and Air BnB type of rental arrangements, there are some real challenges when selling. Those types of reservations, when done solely through the property owner, are automatically not transferrable when selling. If a buyer is relying on the income of your home to make the purchase, you could run into some real issues at the closing table. Even if you are renting through a traditional property management company, there can be cancellation fees you incur if the new buyer doesn’t stick with the company. It’s becoming increasingly more important to employ the proper timing strategy to sell, depending on the source of your weekly guests. Talking to an agent ahead of listing about how the transfer works will help avoid any major stresses once the home is under contract.

COVID-19 & the OBX Real Estate Market

The real estate market is adapting quite well to the current restrictions and Stay at Home order that is in place for North Carolina. While we are doing some things the same, since our market is largely based on out of town property owners, many things have changed to keep things going smoothly.

Here’s what’s new:

1. Virtual Showings – While my listings always feature high end professional photography, this week I’m also getting them all set up with 3D Virtual Tours. This will give prospective buyers the feeling of actually being in the room. We are doing FaceTime and Zoom showings for buyers as well.

2. Virtual Open House – Our local MLS is implementing a new feature to promote and hold and Open House virtually. The details of this feature are still being released. This is an exciting update to a market like ours. I can see this being a great new tool used on the regular after this event is over. I’ll be setting up a few of these in the next week. Contact me if you’d like to participate.

3. Appraisals – Local lenders have assured me that when it makes sense, underwriters are giving appraisers the green light to perform desktop appraisals. This way, properties with high risk inhabitants don’t have to be exposed, yet we can still make progress on the sale of the home.

4. Lenders – With the IRS unable to process any transcript requests before closing, our local lenders have been authorized to skip that requirement for the time being. It will no longer be needed to receive a clear to close. This is showing great versatility and willingness to keep transactions moving.

5. Virtual Closings – While NC does not currently support virtual notaries, you may be in a state that does. We have been doing out of town closings as long as I’ve been in the business, so that part of it is nothing new. Virtual notaries are approved in 35 states. So if you have a closing coming up and need documents notarized check and see if they can do it online instead.

6. COVID-19 Addendum – NC Realtors did quickly create and distribute a special addendum regarding this pandemic that allows buyers and sellers to have a little more time to close if delays occur related to the shutdowns. It also allows the buyer to cancel if they get laid off and become unable to close due to not obtaining loan approval. Lenders will still be verifying employment 5 days before closing.

7. Some not so welcome news – minimum credit scores have been raised to 640 or 680, depending on lender. This is up from 580 minimum. We are also seeing some lenders no longer locking in Jumbo rates. So we may see Jumbo loan guidelines get an overhaul and be much stricter (anything over $510,400), and some no longer doing these loans at all for a while.

Overall, it’s all about adapting. Which we are doing. If you are thinking about buying or selling, we can still make that happen for you.

In fact, of the 112 properties that have gone under contract in the last 30 days, more than 50% of them were also just listed in the same 30 days. Some will be more comfortable moving forward at this time, and some won’t. Either way, please let me know how I can help.

February 2020 OBX Market Update

For 2020, it looks like good news for the OBX market finally! Some spots are really on fire right now. My prediction is we should see some pretty steady growth in the area for the next 3 to more likely 5 years. This is right in line with the 20 year cycle I’ve mentioned before. If you remember 2000, we had the big building boom, we started seeing inventory levels drop and noticed a feeling of something big happening.

This is the same feeling we have right now. Inventory levels are low, interest rates are super low and activity is on the rise. Here are the specifics:

- January residential sales were up 22% over January 2019

- January 2020 had the highest January sales numbers since 2005

- Under contract numbers for January are up 18% from Jan 2019 and are even up 17% just compared to December 2019

- Residential inventory is down 11%

Let’s now look at how each area is performing:

Corolla

306 Active Listings 36 Under Contract 10.5% of inventory selling

Duck

68 Active Listings 21 Under Contract 24% of inventory selling

Southern Shores

47 Active Listings 9 Under Contract 17% of inventory selling

Kitty Hawk

35 Active Listings 18 Under Contract 35% of inventory selling

Kill Devil Hills

101 Active Listings 44 Under Contract 31% of inventory selling

Nags Head

121 Active Listings 44 Under Contract 27% of inventory selling

While Corolla is still behind the curve, I do feel like this may be the last year it’s struggling. It’s about time for a turn around.

If you are thinking of selling now, or in the next year or two, please give me a call so we can discuss what needs to be done to get your home ready for the market. Buyers needs have changed quite a bit. To ensure a fast sale for the most money, you’ll need to put your home through my proven checklist of readiness.