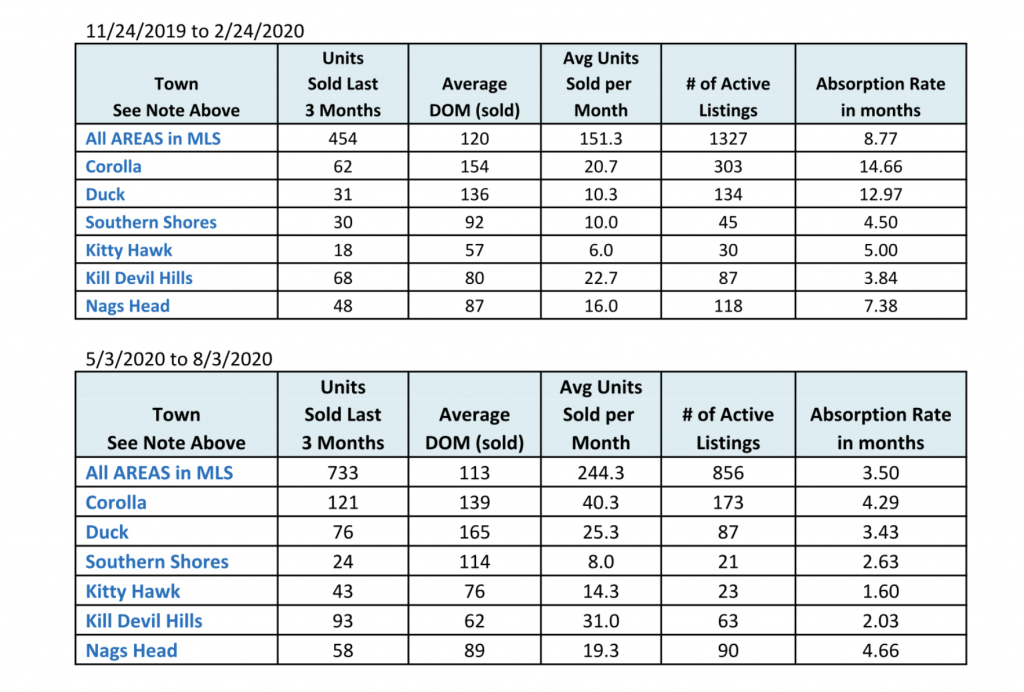

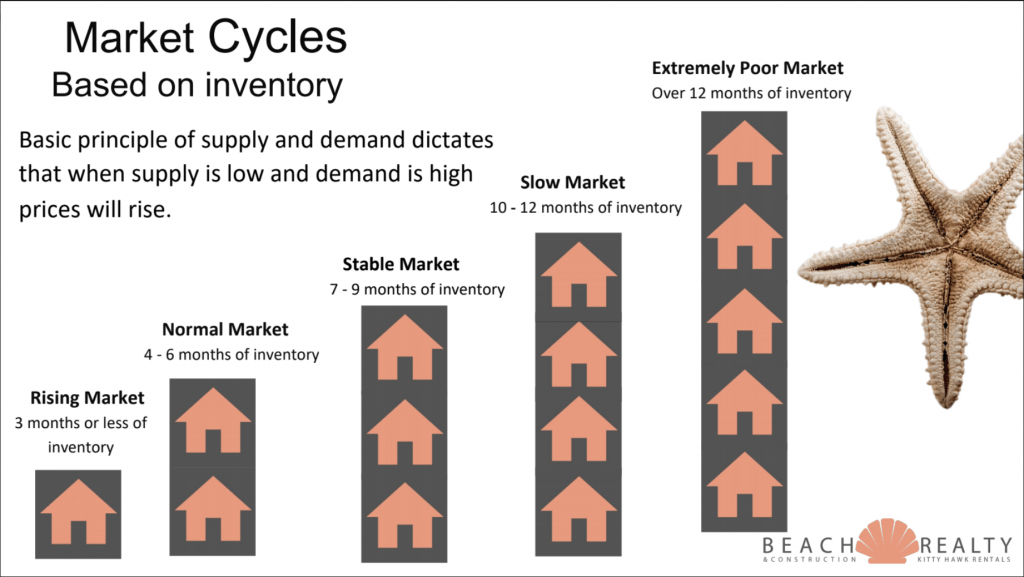

Supply and demand. That’s the basic economic principle driving markets for decades. Here we are! Finally experiencing some movement in the northern beaches market, after the slowest recovery ever from the 2008 market crash.

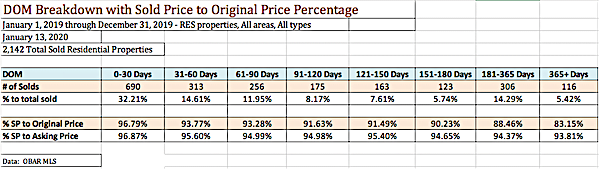

Sellers – if you want to cash in – now is the perfect time! Condition is still important to maximize profits, so contact me before any repair work so we can make the most of your investment.

Buyers – be pre-qualified, ready to sign an offer, prepare to offer virtually, and be prepared to offer over asking price in many cases. You need someone scanning the new listings daily. Now is not the time to go unrepresented. Let me know if you’re looking!

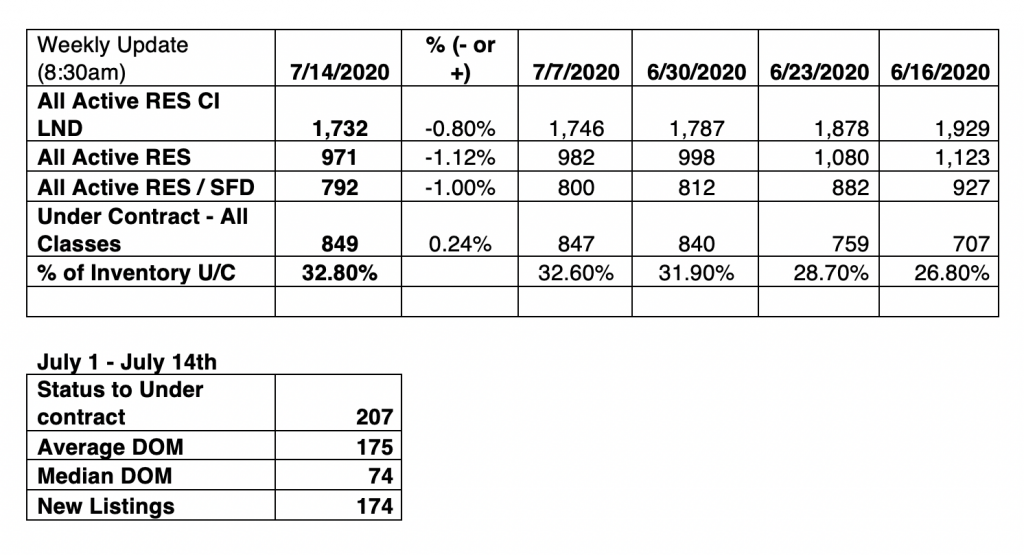

Corolla

57 Active listings 108 Under Contract

Duck

23 Active listings 22 Under Contract

Southern Shores

15 Active listings 19 Under Contract

Kitty Hawk

6 Active listings 17 Under Contract

Kill Devil Hills

24 Active listings 65 Under Contract

Nags Head

38 Active listings 38 Under Contract

Now you can see what we are working with. Contact me if you have any questions about our current market.

I do predict it will last this way through the year.